Pessimists outnumber optimists.

The Westpac Melbourne Institute Index of Consumer Sentiment fell by 2.2% in March from 101.3 in February to 99.1. Responses to the question ‘time to buy a major household item’ fell by 6.6% to be 2.5% below its level from a year ago.

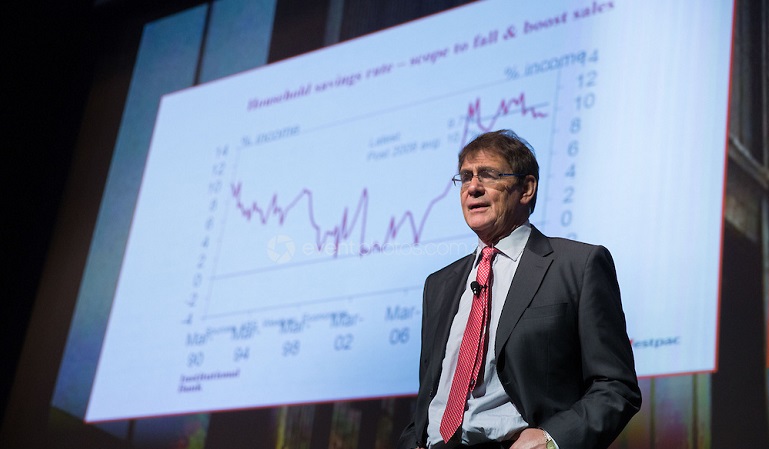

Meanwhile,the ‘time to buy a dwelling’ index increased by 5.4% from 99.3 in February to 104.7 in March. This Index is now 3.0% above its level in September but still 13.1% below its level of a year ago. Westpac’s chief economist, Bill Evans (pictured) said, “the divergence between this index and views on real estate as an investment may reflect uncertainty around potential changes to taxation policy affecting negative gearing.”

Notably, the state detail on ‘time to buy a dwelling’ shows buyer sentiment in NSW, the weakest state, is now 44% above its September low although it is still 19% below its level from a year ago.

This measure is one of three of the five components of the Index which fell in March. One of the two components assessing family finances – ‘family finances compared to a year ago’ – declined 8.2%.

The Reserve Bank has indicated that it favours this component as a reliable indicator of spending intentions. As such, it would be of some concern that this component, which unlike the overall Index did not lift significantly following last year’s leadership change, is now down 5.9% from a year ago, a considerably weaker read than the 0.4% decline in the overall Index.

It said that the prudent approach to this sharp move will be to assess the degree to which it is sustained over future months.

“The other family finances component – ‘family finances over the next 12 months’ – increased by 0.2%. The components measuring the views on the economic outlook sent conflicting messages: ‘economic conditions over the next 12 months’ increased by 8.2% while ‘economic conditions over the next 5 years’ fell by 2.5%.

The Westpac Melbourne Institute Index of Unemployment Expectations also increased by 1.3% from 145.3 in February to 147.3 in March. This measures respondents’ assessments of the outlook for the unemployment rate so an increase indicates reduced confidence in the employment outlook.

The measure is still 5.8% below its print in September but has steadily lifted (up 9.2%) from the low in October (134.9). However labour market expectations are still considerably less negative today than they were through most of 2014 and 2015.

“The Reserve Bank Board next meets on April 5. As we have been successfully arguing since June last year that we expect the Bank will keep rates on hold through 2016. Clear issues for the Bank will be the progress towards stability in the labour market and the value of the Australian dollar,” Evans said.

“Recent dollar strength has been associated with a more positive outlook for China and commodity prices and as such would not be grounds for a policy adjustment. Equally, while most indicators, including our own, one of which is quoted in this survey, point to an overall improvement in the labour market over the last six months, actual jobs growth appears to be running ahead of those indicators.

“The recent lift in the recorded unemployment rate to 6.0% seems consistent with that observation. Given the recent GDP report showing Australia grew by a relatively impressive 3% in 2015, the current unemployment rate is a long way short of a print that would prompt a policy response from the Bank.

“We expect growth in the Australian economy of 2.8% in 2016 with the genuine prospect for some stability in our terms of trade through the year, laying a foundation for a lift in incomes and spending going into 2017”, Evans concluded.