Unaware of true financial position.

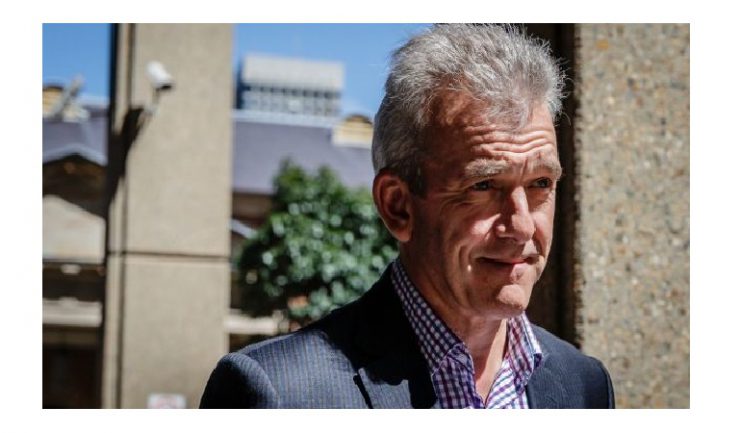

Dick Smith chairman Robert Murray faced the NSW Supreme Court on Monday for examination. He reportedly maintained that he was unaware of the factors that led to the retailer’s demise until it was too late, and defended the company’s strategy of rolling out new stores and taking on more debt.

“I didn’t have a crystal ball and wasn’t aware of the trading challenges the company was about to encounter, so it seemed reasonable,” Murray reportedly told the court.

He said he relied upon the sales forecasts provided by Dick Smith’s chief financial officer Michael Potts and chief executive Nick Abboud. He later learned that what he had thought were brick-and-mortar sales figures, included click-and-collect purchases.

When he joined the Dick Smith board in December 2014, Murray reportedly said, he was not aware of the company’s true position. “I was initially told the company had no debt…When I got into the role I quickly became aware that we had an $82 million facility with Westpac.”

Of the decision to raise Dick Smith’s credit facility to $135 million, he responded, “I could see the business was getting bigger and needed a bigger facility. We believed that there was an opportunity to open more stores and, as long as those stores could trade profitably, then that was a good idea.

“In the context of our total inventory of $39.7 million over the year in which we opened 17 Move stores, including a $50 million-a-year store at Sydney Airport, it didn’t seem to me that the inventory increase year-on-year was untoward or excessive. I accepted management’s view that out stock reduction target was realistic. I certainly believed that I should trust their professional competence.”