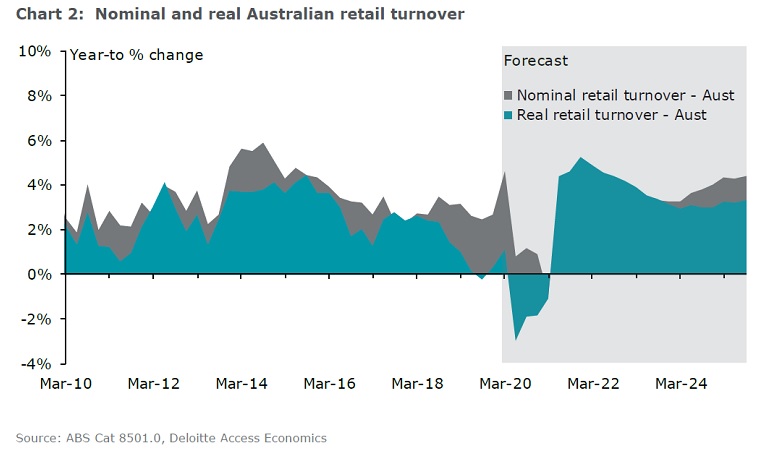

Real retail turnover growth is expected to fall 1.4% in 2020, making it the worst year on record, according to Deloitte Access Economics’ Q2 2020 Retail Forecasts subscriber report.

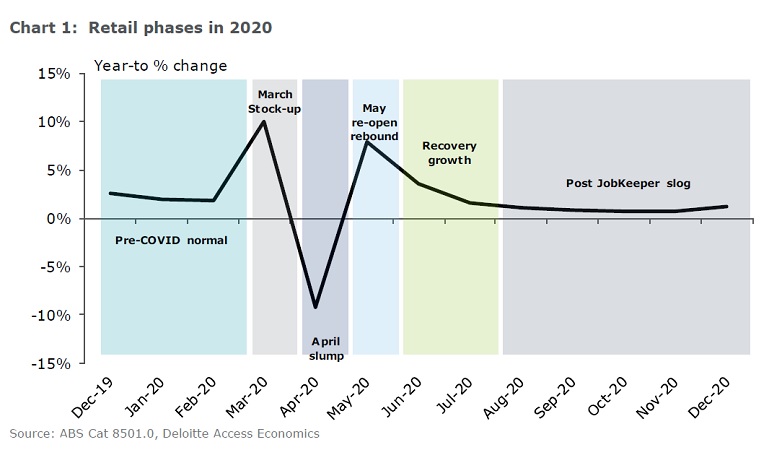

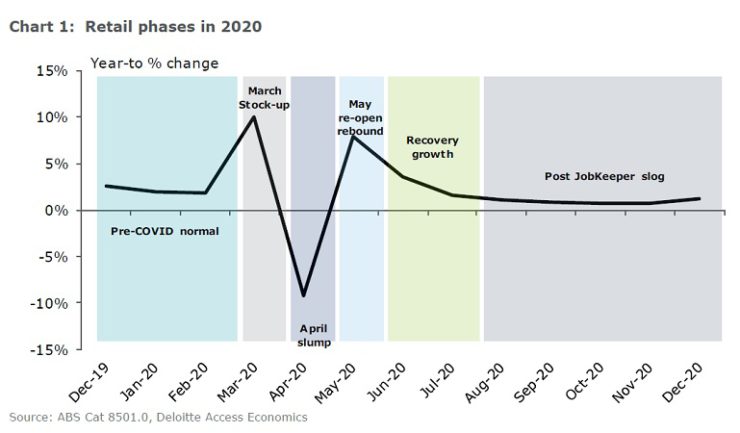

After a surge in growth over the March quarter, retail spending is expected to contract by 4% in the June quarter as the COVID-19 outbreak and associated restrictions limit spending. There have also been significant swings in consumer ability and willingness to spend during 2020, and those swings may continue as the year goes on.

2020 has been a tumultuous year for retailers, Deloitte Access Economics partner, David Rumbens said. “And we are not even halfway through, but across the whole sector we expect calendar 2020 to register a record breaking fall in real retail sales.”

He warned that the recovery path for retail spending was precarious and short-term risks from rising unemployment and reduced willingness to spend will linger, especially as fiscal stimulus programs are unwound in September. “More worrying is the longer-term risk from weak population growth. Migration has been an important support for retail spending over the past decade, but with borders closed there is potential for this tailwind for growth to turn into a headwind.”

Increased uncertainty and a lower willingness to spend are likely to hurt demand for some products and services more than others. Consumers report that those products seen as discretionary – or non-essential – are likely to experience the greatest falls over the coming weeks, while essential items are less likely to experience the same pressure.

On average, 33% of survey respondents indicated they were going to pull back on spending for more discretionary items, compared to just 8% for less discretionary items. “That is not to say consumers can’t be enticed to spend, with 40% stating that if they were to find a good deal on a non-essential item that they would buy it.”

While the average is dire, there may not be many retailers performing at the average and many will fare much worse, while supermarkets, pharmacies and hardware, amongst others, have been experiencing a golden run.

“Consumer willingness to spend will likely be buffeted by a number of different factors, meaning that one month’s trading experience may be a terrible guide to how the year as a whole pans out.”

Rumbens said this includes a ‘COVID normal’ period, where sales are buoyed by an improving economy,picking up from a very deep trough, that continues to benefit from income support measures like JobKeeper, deferral of mortgages, access to super etc.

What is expected to follow is the post JobKeeper slog. “September is already flashing red for many retailers as the month for the intended end to JobKeeper, and therefore the significant support many businesses,including retailers, have been receiving. That may see the last phase for retail in 2020 as a fairly sombre one, leaving many retailers to dream of the support they received when COVID was at its peak.