Still declining with consumers.

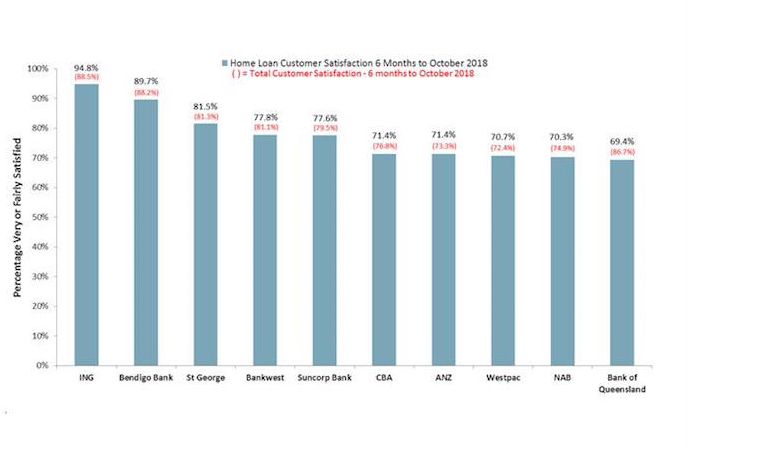

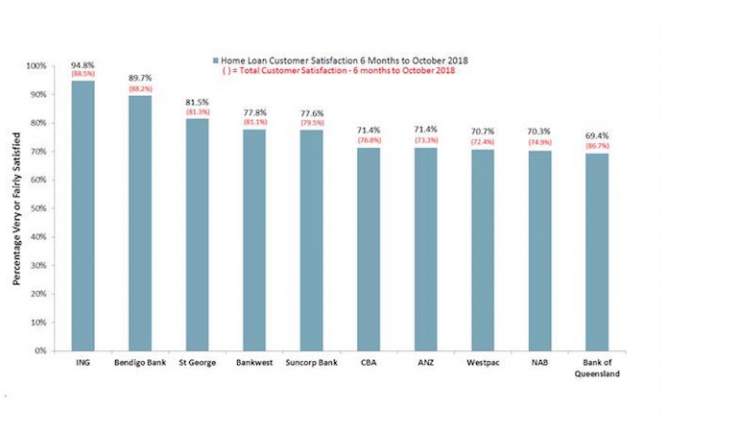

New results from Roy Morgan show that in the six months to October 2018 satisfaction with banks, particular the big four, CBA. ANZ, Westpac and NAB, has fallen further to 78.0%, from 78.5% in September.

Given the high volume of negative publicity relating to the big four banks that continues to be generated by the Royal Commission, it is not surprising that customer satisfaction with them has shown greater declines than for other banks this year, according to Roy Morgan industry communications director, Norman Morris.

“This has resulted in satisfaction with banks overall currently being at their lowest level since 2011. What needs to be noted is that contrary to all the negative reporting on banks, the clear majority of their customers remain satisfied with them and only around 6% claim to be dissatisfied.

“It is somewhat surprising to see that even with historically low interest rates, home loan customers of the big four banks are not only less satisfied than their other customers but are well behind the satisfaction of the home loan customers of the smaller banks. This remains a problem in the highly competitive home loan market as well as being a drag on their overall satisfaction and advocacy levels,” Morris said.

ING is the highest home loan performer, among the 10 largest banks, with 94.8% satisfaction, followed by Bendigo Bank on 89.7%. Both of these banks have higher satisfaction among their home loan customer than they have with their customers overall. They are followed by St George, Bankwest and Suncorp Bank 77.6%. The big four banks all have similar satisfaction ratings among their home loan customers, with CBA and ANZ both on 71.4%, followed by Westpac on 70.7% and NAB 70.3%.