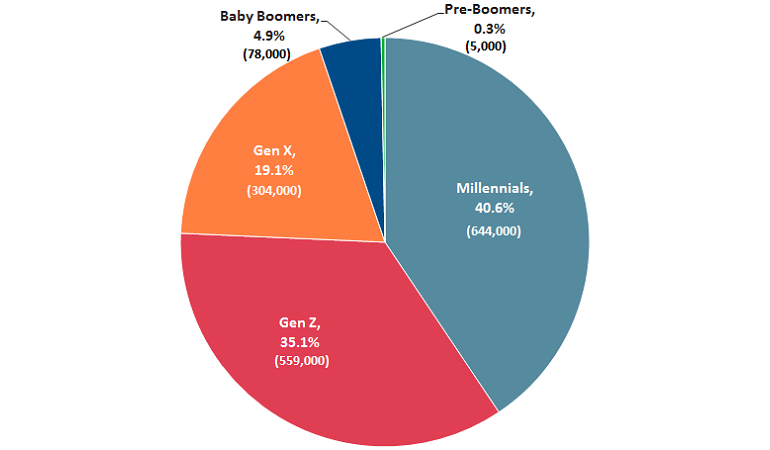

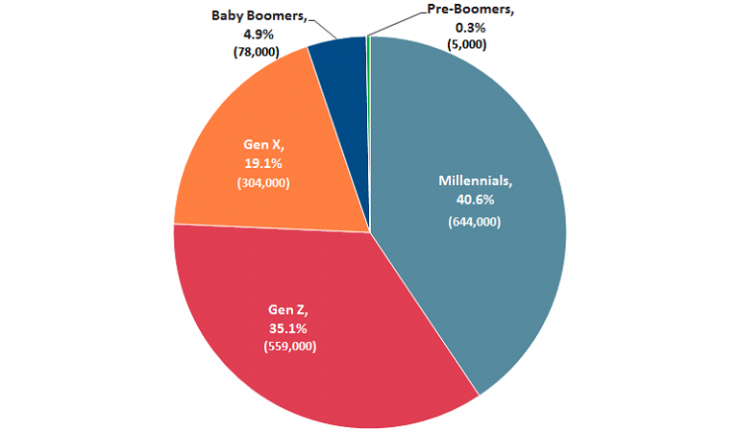

Predominantly Millennial generation.

In the 12 months to January 2019, 1.59 million Australian consumers used buy-now-pay-later (BNPL) digital payment methods, according to findings from the Roy Morgan Digital Payment Solutions Currency Report.

Millennials make up the biggest share, accounting for over 40.6% of BNPL users, followed by Gen Z with 35.1%. By contrast, baby boomers and pre-boomers make very little use of the systems with a combined market share of only 5.2% or 83,000.

Awareness of these BNPY payment methods sits at 42.9%, well ahead of the 7.7% usage levels and as a result provides a positive growth outlook.

The major player in this market is afterpay with 39.9% awareness and 6.9% usage over a 12 month period, ahead of second placed Zip with 19% awareness and 1.6% usage.

Roy Morgan industry communications director, Norman Morris said, “The payment environment in Australia is facing rapid change as we see innovative new companies changing the way people purchase goods that they may not be able to afford immediately.

“These BNPL companies are likely to pose a threat to traditional payment types such as credit cards as well as traditional financial institutions, as consumers can access a small amount of credit instantly with no documentation.

“The increasing use of new payment technologies is being aided by the growing proliferation and development of smartphones and wearables with integrated technology such as Apple Pay and Google Pay.”