Household purchase intentions dip.

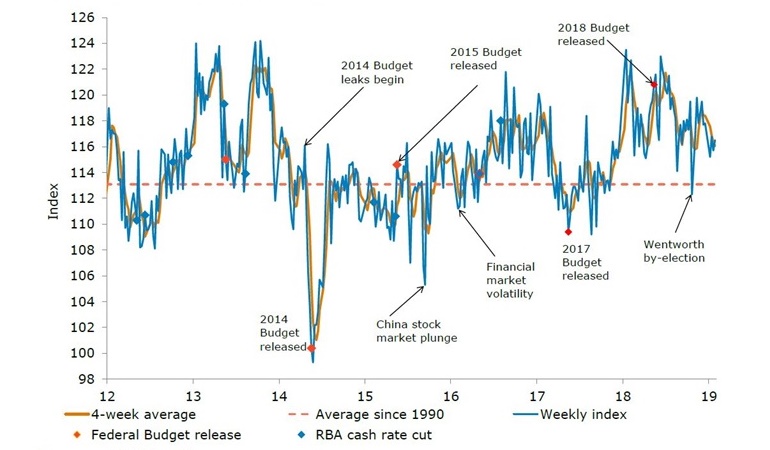

The ANZ-Roy Morgan consumer confidence index rose 0.7% last week, continuing its up-down-up pattern. However, the ‘time to buy a household item’ index fell 3.9%, its lowest level since October.

Financial conditions were mixed, with current financial conditions gaining 2.2% and future financial conditions declining by 0.9%.

Economic conditions sub-indices were positive with current economic conditions gaining 1.7% while future economic conditions jumped 5.9%. This leap took future economic conditions back to where they were in mid-December.

ANZ head of Australian Economics, David Plank, said consumer confidence has been volatile in January, with no clear trend. “We think the bounce over the past week was likely due to encouraging employment numbers on the domestic front and the end of the US government shutdown.

“Importantly, consumer sentiment remains well above the long-run average and provides some offset to the recent downbeat news on business conditions. Critical to continued good cheer for households will be the performance of the labour market.”