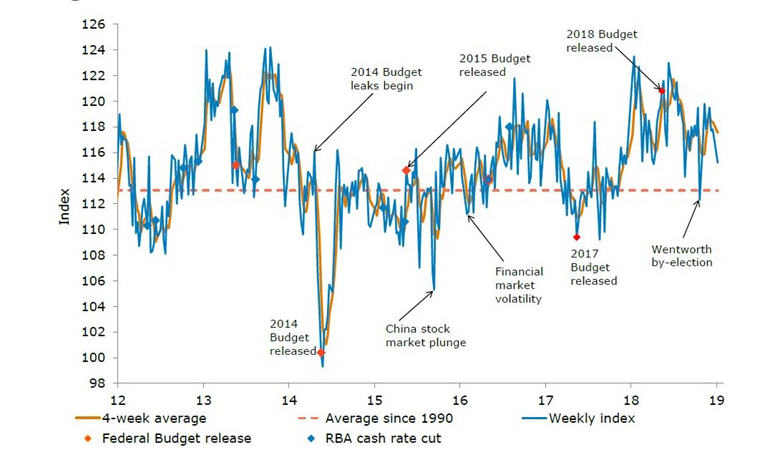

Current and future economic conditions and the ‘time to buy’ a household item all fell in the first week of January.

The latest ANZ-Roy Morgan data showed consumer confidence fell 2.2% while current and future economic conditions declined 4.2% and 3.1% respectively. However, future financial conditions bucked the overall trend and rose 1.1%. The ‘time to buy a household item’ also fell 1.1%.

According to ANZ head ofAustralian economics, David Plank, while consumer confidence started the new year on a weaker note there are a number of factors likely at play.

“Much of the global news has been negative over recent weeks, with broad weakness in equity prices since the last confidence survey in December reflective of this. More recently the Chinese PMI fell below 50 for the first time in 19 months and the stand-off between the US Congress and the president has intensified,” he said.

“On the domestic front sentiment has likely been affected by the media’s focus on falling house prices. On the positive side, lower petrol prices will be helping sentiment and the strong US payrolls report shows there is still plenty of momentum in the US economy. And we should keep in mind that consumer confidence still remains above average.”