Help with cash flow and admin.

In the lead up to Christmas, Australian small business owners are compromising their personal wellbeing to deal with business pressures. This includes cash flow, compliance and regulation, according to a Westpac Small Business Report in collaboration with professional services firm, Deloitte.

Almost 58% of small business owners said they expect to miss out on sleep due to work demands during the Christmas period, 63% won’t have a chance to relax and wind down over the holiday season, and 58% will miss out on spending time with family and friends. Further, four in ten business owners will receive payments from debtors later over the Christmas period, and spend eight hours per week, on average, chasing outstanding invoices to alleviate cash flow pressures.

Westpac general manager of SME banking, Ganesh Chandrasekkar said small businesses are spending up to one working day every week chasing invoices. “Cash flow is the life blood of any business and being able to manage it is extremely important, especially in the lead up to a busy period like Christmas.”

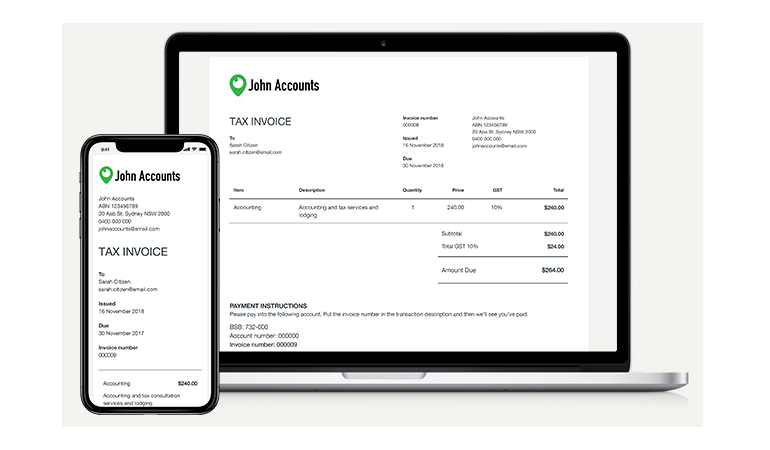

He said Westpac Biz Invoice is the first integrated invoicing payment solution from a major Australian bank that allows businesses to create and send secure and customised invoices direct from Westpac Live online banking at any time. “Through Biz Invoice businesses can have better visibility of their cash flow position, send reminders when invoices are overdue and receive payment notifications,” he said.

In addition, Westpac has signed the Australian Supplier Payment Code to help address cash flow challenges faced by small businesses by committing to pay all suppliers on time and work with them to improve invoicing and payments practices.

“Biz Invoice positions us well ahead of the federal government’s roll out of e-Invoicing next year which will standardise electronic invoices to help reduce admin costs and boost productivity for small business.”

Another burden for small business owners is paperwork, with many dedicating up to 12 hours each week with compliance and regulatory tasks. Deloitte Access Economics estimate the cost of regulation to Australian businesses is $100 billion annually.

Despite the challenges, Chandrasekkar said the report highlights that over one third of businesses feel positive about the Christmas season, and the most profitable businesses are driving revenue growth through improvements and introducing new products and services.

“We found the businesses that experienced growth in sales, profitability and productivity were those that are ‘innovation active’. They tend to put effort into significantly improving their operations or offering new goods and services, and considering the big picture rather than the day to day of running a business,” he said.

As 2019 approaches, Chandrasekkar said despite some headwinds the outlook for small businesses remains positive.

“GDP growth is expected to slow back to 2.7% next year and there will be some additional uncertainty due to the Federal Election, a soft housing market and lacklustre consumer demand. Despite these pressures, employment growth is expected to remain quite strong, with continuing above-average investment in private and public infrastructure. Competitive assistance from a lower Australian dollar is expected to continue along with rising exports and solid population growth.”