40 per cent growth in 2017.

The virtual reality (VR) headset market in Australia is showing strong growth, but high device costs, rapid pace of innovation and lack of clear market winners is constraining adoption. However, augmented reality (AR) is predicted to gain broader acceptance than VR with higher levels of accessibility and more use cases.

The VR headset market grew 40% in 2017, with 302,000 devices sold, according to new research from technology analyst firm Telsyte.

“Australian consumers and developers are taking a ‘wait and see’ approach to VR,” Telsyte managing director, Foad Fadaghi said.

Telsyte forecasts that 2.2 million households will have a VR headset by 2021, with the main applications being in entertainment. VR headset annual revenue is expected to grow to more than $200 million by 2020, up from $79 million in 2017.

The market leader in VR headsets was Sony PlayStation, which benefited from selling VR as an accessory for the PlayStation 4, and its ability to attract leading games publishers. Sony PlayStation has announced over 50 new VR games titles for 2018.

As awareness has advanced, health concerns surrounding VR has plummeted, with only 5% of survey respondents concerned about negative health implications of VR, down from 36% in 2016.

AR – the overlaying of computer-generated digital images over a camera feed of the real world on devices such as smartphones, tablets, and headsets – is expected to have a greater take-up than VR. Popular AR apps such as Pokémon GO and Snapchat photo filers have helped rocket AR into the mainstream, with one in three Australians said to have tried AR applications, according to Telsyte.

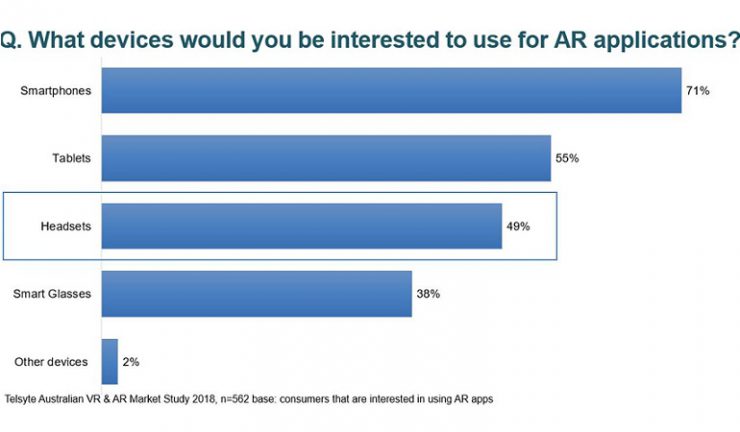

Telsyte research showed that 67% of iPhones used in Australia are ARKit compatible (Apple’s AR development platform), and 23% of Android phones are AR core compatible (Google’s AR development platform). While most AR applications are currently being developed for smartphones and tablets, Telsyte forecasts that consumer AR headsets and smart glasses will be commercially available towards the end of 2020, some combining AR and VR functionality.

Enterprise interest in AR is also higher than VR with 46% of organisations investigating or implementing AR applications. Customer facing applications (40%), location-based services (38%) and project management (37%) are the main applications being developed.

Most organisations building AR apps are developing these for the iPhone (74%), followed by iPad and Android smartphones (64%). Like VR, lack of skills and technology maturity are the key barriers for AR with almost one in three organisations identifying both as barriers.

“With a large established installed base of augmented reality capable smartphones and tablets, AR is becoming the ‘go to’ option for businesses that are experimenting with immersive technologies” Fadaghi said.