Downbeat on big ticket spending.

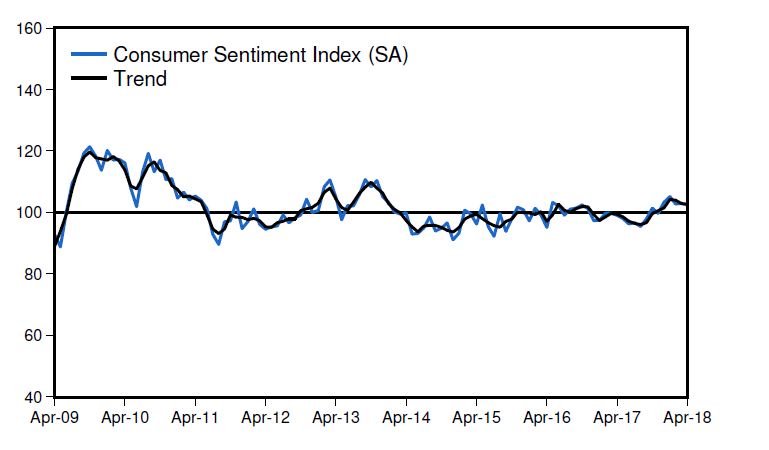

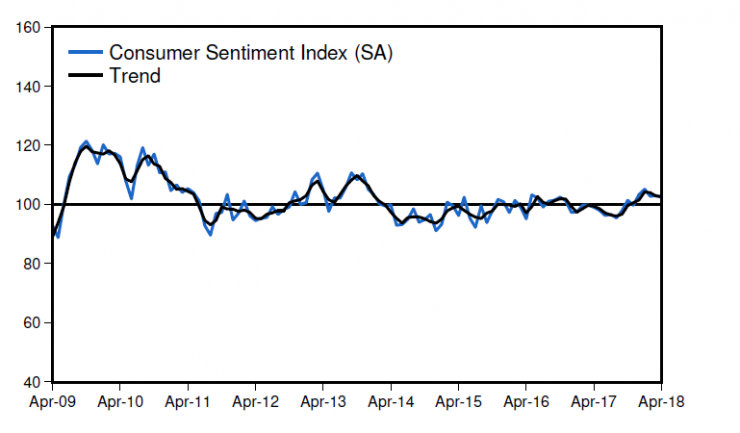

The Westpac Melbourne Institute Index of Consumer Sentiment declined 0.6% in April, although still sitting in slightly optimistic territory. This is the fifth consecutive month the index has been above the 100 level, indicating optimists still outnumber pessimists. “That is a more encouraging signal than seen during most of 2017 when pessimists outnumbered optimists,” according to Westpac chief economist, Bill Evans.

However, the 10% rally through the second half of 2017 has stalled with the index falling by around 2.5% since the beginning of 2018, still well below levels typically associated with a robust consumer, Evan said.

“The survey detail shows Australians are more uneasy about family finances and jobs but a touch more confident about the economy. The sub-index tracking views on ‘finances, for the next 12mths’ posted a sharp fall of 5.8%, with April marking the lowest read since last September. With stock market volatility persisting over the last month, and house prices declining since the start of the year, respondents have become more nervous around the outlook,” he said.

Responses to additional questions on news recall last month showed ‘international conditions’ were more prominent and viewed significantly more negatively than in December.

Consumers still remain relatively downbeat on spending for big ticket items with the ‘time to buy a major item’ sub-index declining 1.8%, a five month low and well below the long run average.

Views around housing showed little change. The ‘time to buy a dwelling’ index edged 0.5% lower, reversing most of last month’s small gain, well below its long run average and was considerably weaker in Sydney and Melbourne. “However it is worth noting that this index is well above the levels seen in 2017 when house prices were booming and affordability concerns were impacting respondents,” Evan said. “The overall Index is up around 8% on a year ago while Sydney and Melbourne showed some significant improvements in confidence.”

Evans expects there is little chance of a rate hike when the Reserve Bank Board meets on May 1. He said markets, which six months ago were fully priced for a move up by August 2018, are now not priced for a move until mid- 2019. “Westpac continues to expect the cash rate will remain on hold through 2018 and 2019,” he said.