As Face ID gathers momentum.

Look out. Face ID about. The fingerprint sensor market is facing a major disruption following the arrival of the facial recognition system Apple developed for its iPhone X and the entry of other competitors to the market.

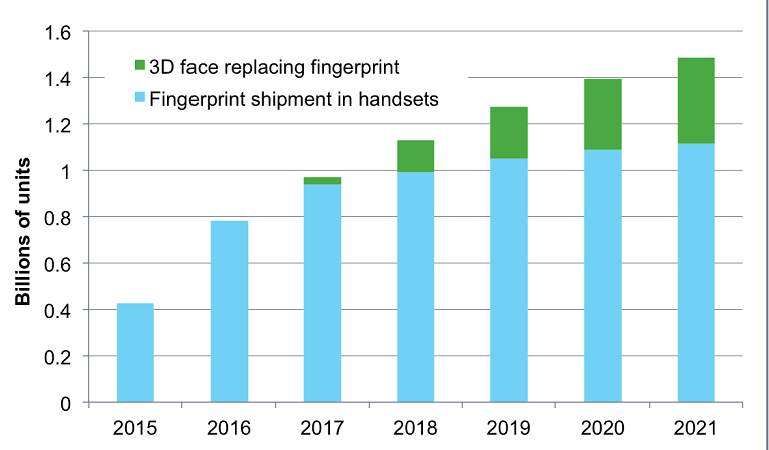

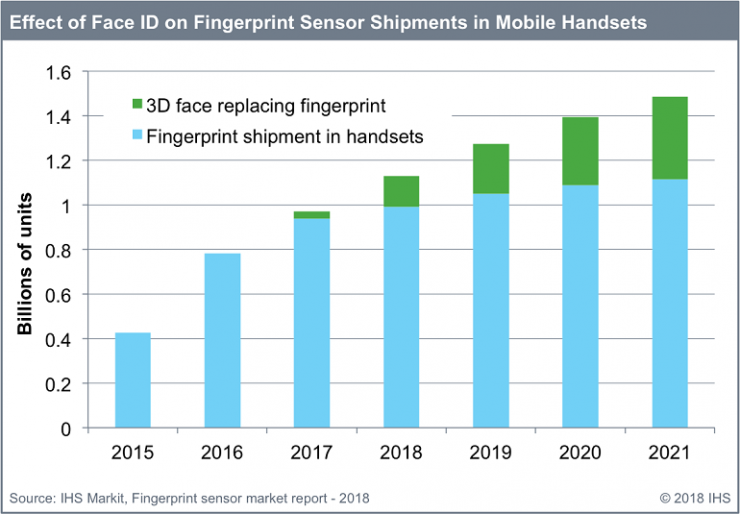

Apple’s decision to replace Touch ID with Face ID will lead to 1.1 billion fewer fingerprint sensors produced by the end of 2021, than if Apple had maintained Touch ID in its iPhones. Based on handsets, this estimate is the combined total from both Apple and other competitors that will follow with their own 3D face-recognition solutions. It does not include the lesser effects of Face ID on notebooks and tablets.

The launch of Face ID will also reduce fingerprint sensor shipments to other manufacturers already looking to replace them with a new solution, according to IHS Markit principal analyst for LEDs and lighting, Jamie Fox.

“As the market moves to under-glass sensing, ultrasonic and optical sensors will replace capacitive sensors that cannot send signals through glass,” Fox said. Over the next two to three years, the fingerprint sensor market is expected to move towards a true “in-display” solution, where the sensor is not just under the display but also integrated into the display itself, he said. “These sensors will likely recognise fingerprints in a large area of the display, or even the entire display, rather than solely on a fingerprint-sensor button.”

The market for fingerprint sensors is not forecast to grow as quickly as it did in 2015-2016, and as a result fingerprint sensor makers are looking for new markets with the hoped-for growth in fingerprint sensor sales for smart cards starting in 2018, Fox said. “Other fingerprint sensor markets in the future are likely to include automotive and door locks, which could turn out to be big long-term opportunities for the industry,” he said.