The largest major appliance market.

The consumer appliances industry is expected to grow by 3% in retail volume terms to reach 2.6 billion units sold in 2016, according to the latest research from Euromonitor. While Eastern Europe and Latin America continue to struggle, Asia Pacific remains the largest major appliances market, accounting for more than 44% of global volume sales, thanks to strong demand from emerging countries, including India, Indonesia and Vietnam.

Euromonitor International head of consumer appliances, Jamie Ko said, “Indonesia will post the highest growth at a 9% compound annual growth rate (CAGR) over 2016-2021. Demand is coming from continued urbanisation through the development of electricity infrastructure and increasing property ownership, as well as lifestyle changes that require more refrigeration appliances at home.

In fact, in 2016 fridge freezers represent nearly half of major appliances sales in Indonesia and this trend will continue through to 2021.”

Health continues to drive small appliances sales, with a rise in popularity of products such as light fryers, air purifiers and juice extractors. “Driven by health trends, slow juicers are displaying the highest growth in 2016. We forecast that the popularity of slow juicers will continue, with global volume sales expected to more than double over 2016-2021,” Ko added.

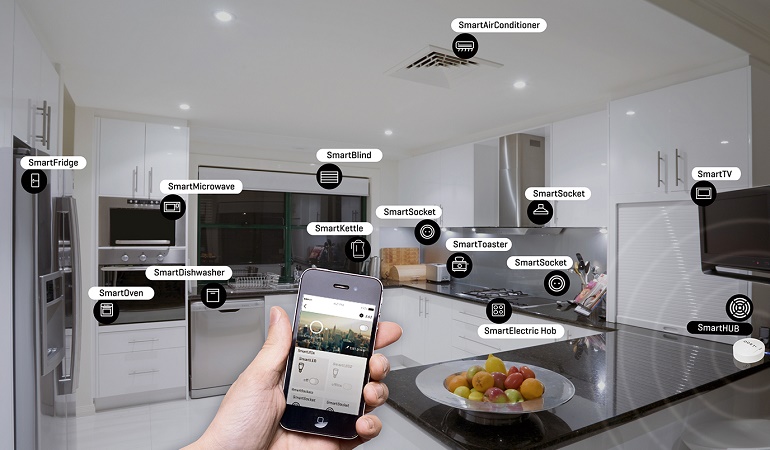

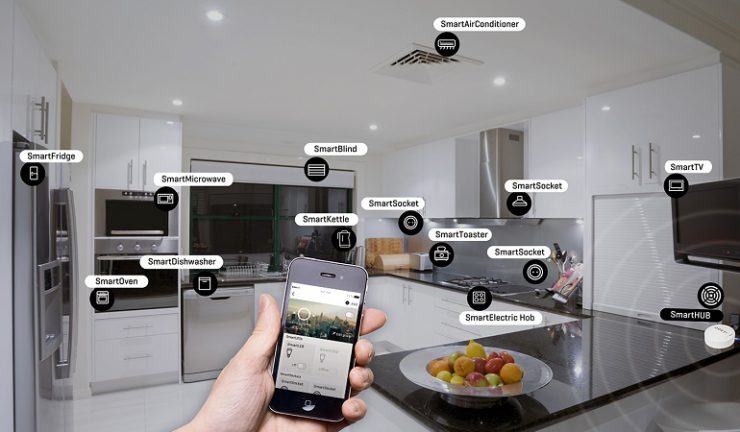

Innovation will play an important role for the future of the appliances market, the research found. Growing from a low base, 30 million units of connected appliances have been sold globally in 2016, half of them in China. However, global growth is expected to pick up strongly from 2016 to 2020, with retail volume sales projected to reach 178 million units worldwide.

Other key findings include:

- Demand for pod coffee machines, which is seeing its popularity spike (up at a 10% volume CAGR over 2011-2016), is expected to drop to a 2% CAGR increase over the next five years.

- Refrigeration appliances registered the lowest volume growth (1%) in 2016, mainly limited by continued declines in Latin America and Eastern Europe, where weak economies have made consumers delay replacing their refrigeration appliances, as well as in China where the consumers’ demand in 2016 has been consumed in advance in earlier years stimulated by government subsidies and manufacturers’ promotion activities.

- The popularity of slow juicers looks set to continue, with global volume sales likely to more than double over 2016-2021. The top five countries (China, South Korea, Japan, the US, and Germany) account for 84% of slow juicers’ global volume sales in 2016

- Robotic vacuum cleaners is expected to post the highest forecast growth among all vacuum cleaners over 2016-2021, with sales up at a 9% volume CAGR, on the back of robust demand from Asia Pacific countries, including Thailand and China.

- Home laundry appliances posted 3% volume growth in 2016, mainly driven by Asia Pacific, where more consumers are converting from top-loading to front-loading washing machines and from hand washing to machine washing due to increases in disposable income.