From the courtroom…

With no concerns.

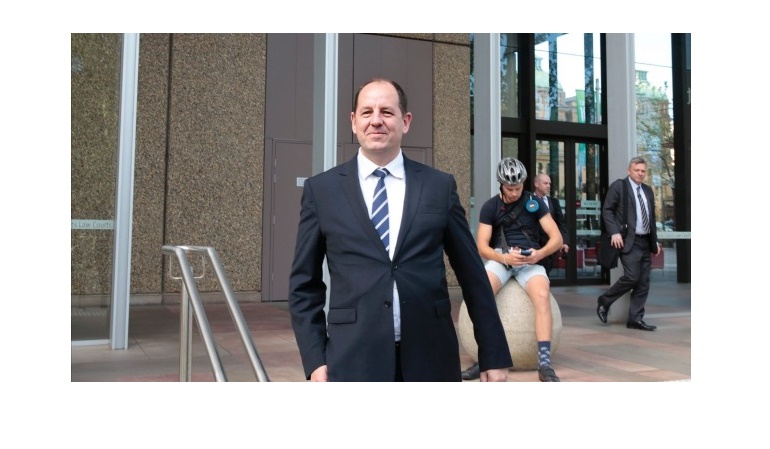

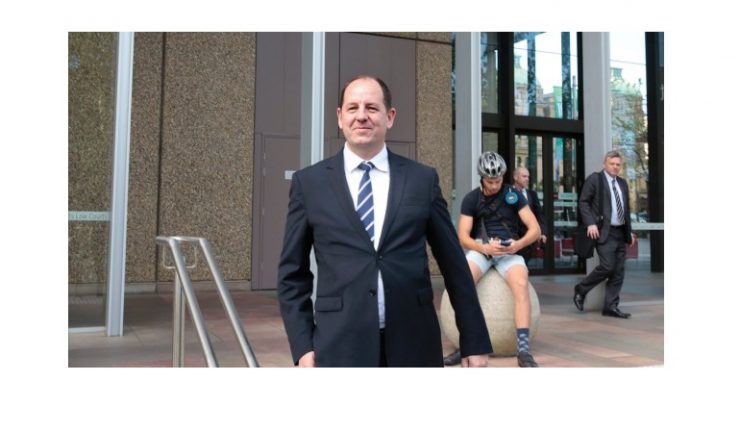

Former Dick Smith CFO, Michael Potts told the NSW Supreme Court on Thursday that he was not concerned that over-and-above (O&A) rebates were distorting buying decisions, until the accounting treatment of rebates was discussed with the company board in late 2015.

Furthermore, when questioned by Ferrier Hodgson if he was concerned about over-and-above (O&A) rebates being a key focus for the company, he responded “No.”

In February 2015, Dick Smith sought a temporary $35 million increase to its overdraft facility with Westpac. When asked why, Potts said “it was required for the business. Cashflow forecasts showed that payments to suppliers were due and there was a change in tracking of sales.”

And was there any concern that divided payments had to be reconsidered? “I was confident that sufficient cash availability and good relationships with the banking syndicates would ensure divided payments were met, based on conversations with the bank and the cashflow forecasts,” Potts said.

He also told the court that he had no concern that cashflow forecasts, which were inherited when Anchorage took over, were being updated on a daily basis. “That is the nature of cashflow. It has to be updated daily. Factors such as sales and timing of payments affect a company’s cashflow.”

Dick Smith was going into debt in amounts in excess of the expected facility of $135 million. When questioned about how the company proposed to pay those out: “With cashflow management, there were a number of solutions at hand, such as talking to suppliers about payment terms and drive sales harder.”

Potts was then asked about the recurring series of overspend in 2015, to which he responded, “I was always concerned about our stock levels – too high or too low – and seeking an explanation.”

“However, if we look through the overspend in July: Pull forward for Father’s Day, extra stock of GoPro, new Kindle launch. As the CEO, Abboud had the authority to approve those overspends. I don’t believe he was directing the purchases, but he was approving them.”