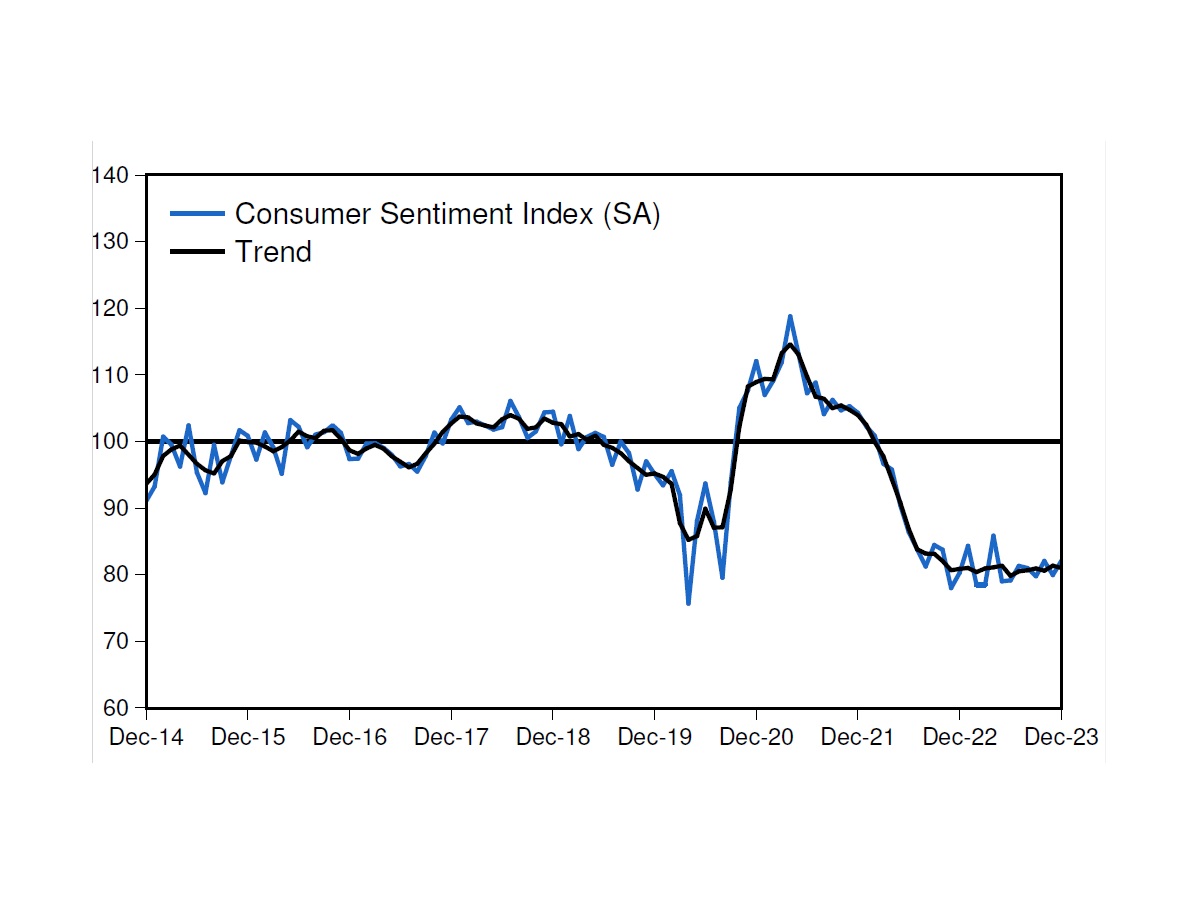

The latest consumer sentiment readings from Westpac rose 2.7% in December, thanks largely to rate rises going into a holding pattern.

However, consumers are far from upbeat, according to Westpac senior economist, Matthew Hassan, and while ending on a slightly improved note, 2023 is still the worst calendar year for sentiment since records going back to 1974, he said. “Despite the reprieve, consumers are still wary of the potential for more rate rises with family finances still clearly under intense pressure.”

While there are some faint glimmers of hope around family finances and the outlook for jobs, these are being overshadowed by still-high inflation and renewed rate rise concerns.

Other news items with high recall in December were, budget and taxation (35%); economic conditions (32%); employment (29%); and interest rates (23%), with consumers assessing these as more negative than positive, but with nearly all assessments improving slightly since September.

The exception was news on ‘interest rates’ which was viewed more negatively than three months ago, and that more increases may be required are clearly impacting.

In what is not good news for retailers, declining purchasing power rather than interest rate moves seem to be the dominant driver of buyer sentiment with the ‘time to buy a major household item’ sub-index falling 3.8%.

However, consumers hold a positive for jobs despite a softening in labour market conditions.

“Housing-related sentiment measures saw small shifts in the month with the main picture still one of extreme tensions between stretched affordability and positive price expectations,” Hassan said.

The ‘time to buy a dwelling’ index rose 1.6% in December, still a very weak level by historical standards. Big lifts in buyer sentiment were posted in Queensland (+16.5%) and NSW (+11.6%) with a more subdued gain in Victoria (+0.7%).

“The subdued growth profile and a particularly weak household sector, suggest there is now a higher bar to further macroeconomic policy tightening,” Hassan said. “The next two months of inflation data and the detailed quarterly release out in late January will be critical to the RBA’s policy decision in February.”