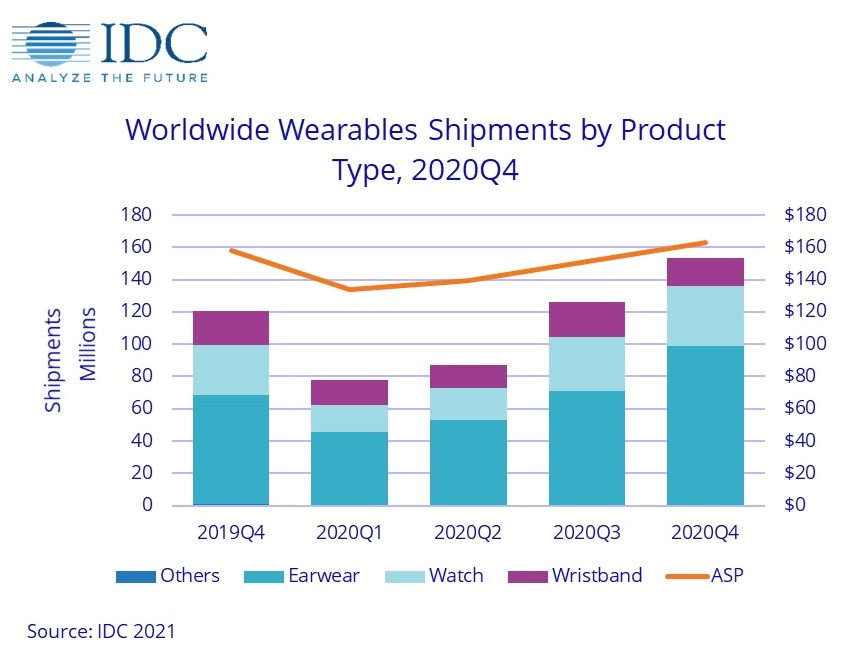

Global shipments of wearable devices reached 153.5 million in Q4 2020, increasing 27.2% year-on-year, according to the latest IDC Mobile Device Trackers data.

Shipments for the full year experienced growth of 28.4% to 444.7 million units as consumer spending on electronics surged during lockdowns and restrictions.

IDC Mobile Device Trackers research manager, Jitesh Ubrani said while the shift in spending along with new products and typical seasonality were at play during the fourth quarter, the pandemic has put health and fitness at the forefront for many consumers.

“In-home fitness programs are quickly becoming a crucial component of the wearables offering for many companies. Beyond that, the proliferation of health sensors such as skin temperature, ECG, and heart rate tracking are allowing users and health professionals to better understand the onset and tracking of diseases.”

Hearables were the largest category with almost two-thirds (64.2%) share of shipments, followed by watches with 24.1% share. According to IDC research director for wearables, Ramon T. Llamas, 2020 was the year that hearables became the must-have device.

“Hearables provided a new degree of privacy, particularly during home quarantine but also while out in public. Meeting that demand was a long list of vendors with an equally long list of devices, spanning the range of feature sets and price points,” he said.

“Underpinning the hearables market was a constantly shifting competitive landscape, with companies slowly gaining a foothold in the market, including Amazon with Echo Buds and Frames, Apple introduced new form factors with the AirPods Max, and new features making their way down the price curve, including automatic noise cancelling and voice assistant capability.”

Apple led the market with 36.2% share of shipments in Q4 with shipment growth of 45.6% due to strong demand for the Series 6, Watch SE and Series 3, offering different price points. Hearable shipments also surged during the quarter, although year-over-year growth slowed to 22%, down from 28% and 29% in the previous two quarters.

Xiaomi ended the quarter in second position, growing 5% year over year. However, the company’s shipments of its Mi Band lineup declined 18.3% during the supply-challenged quarter. Driving overall growth was the expansion of the hearables line, which grew 55.5% since last year and is largely focused on China and the rest of Asia/Pacific.

Samsung held third position with growth coming from its hearables business as the company shipped 8.8 million units. Samsung’s low-cost wristbands saw greater traction and were able to compete with the Chinese vendors, although overall volume for these devices was relatively low at 1.3 million units. Overall watch shipments declined to 2.9 million in the fourth quarter.

Huawei fell to fourth place in the fourth quarter and continued to struggle with the sanctions imposed by the US government. While its shipments within China grew 9.4% year over year, shipments declined in previously strong markets such as Asia/Pacific (excluding Japan and China), the Middle East and Africa, and Western Europe. The company has slowly started to move away from wristbands and towards watches as exhibited by the 18.2% growth in watch shipments and the 33.7% decline in wristbands.