According to new research.

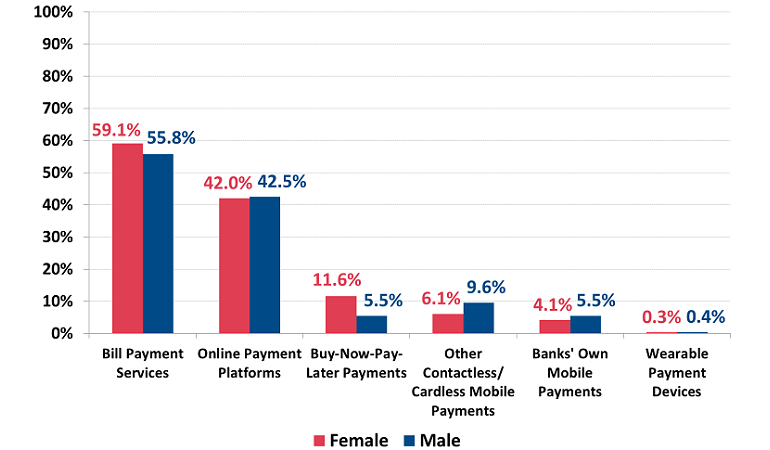

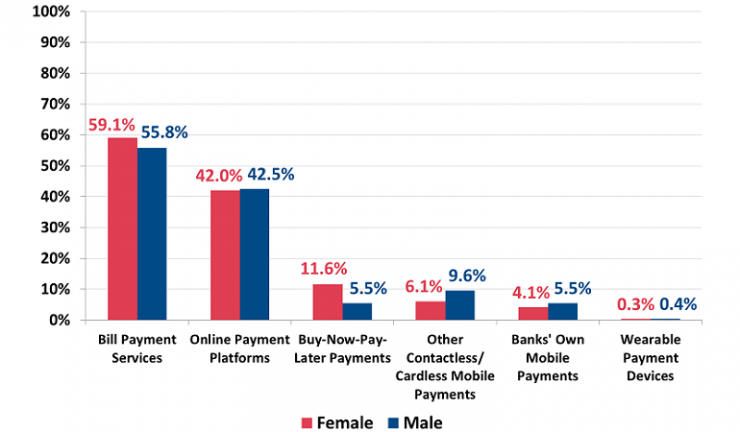

Women are significantly more likely to use buy-now-pay-later (BNPL) services than men with over one-in-10 women (11.6%) reporting using the service in the last year compared to only 5.5% of men, according to new research from Roy Morgan.

Afterpay is the market leader in the BNPL space and has the highest Net Promoter Score of any digital payment solution on 53.6, just ahead of Apple Pay on 53. Word of mouth and recommendations become important once competition or alternatives arrive on the market.

In addition to greater use of BNPL services, women are also more likely to use more traditional bill payment services such as BPAY and Post Billpay with 59.1% using the service in the last year, compared to 55.8% of men.

Usage of digital payment services in last 12 months by gender (Source: Roy Morgan)

However, more men have used online payment platforms such as PayPal, Visa Checkout, Masterpass and Western Union in the last year, in addition to other contactless/cardless mobile payments including Apple Pay, Google Pay or Samsung Pay.

Roy Morgan CEO, Michele Levine said Afterpay has a heavy emphasis on female-centred content on social media channels and products clearly aimed at young women aged 14 to 34 years.

“The success of Afterpay, which is now valued at close to $8 billion, has of course not gone un-noticed. New entrants entering the market include LatitudePay – which has partnered with Harvey Norman, and the Commonwealth Bank which is set to launch its own BNPL service in the near future.

“Increasing number of entrants into the market ensures competitive tensions will be on the rise which leads to greater innovation in the industry as each player seeks to gain the edge on its rivals. These developments should ultimately benefit the consumer with downward pressure on prices for the foreseeable future.”