Masters Home Improvement write-down value causes turmoil.

Lowe’s is believed to be considering taking legal action against Woolworths over the destruction in value in the joint venture, according to Fairfax media reports. The decision to invest in the Masters home improvement chain has seen Lowe’s book a $US530 million impairment in its accounts, as negotiations continue for an exit from the loss-making business.

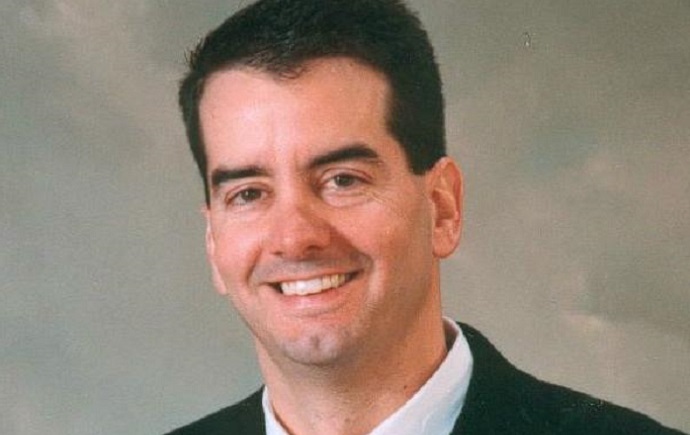

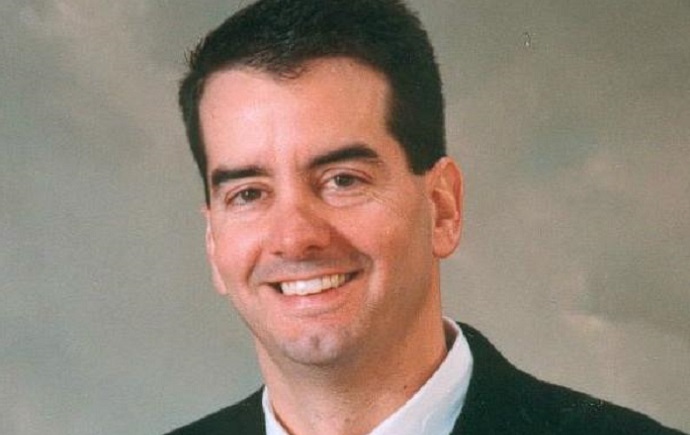

Lowe’s chief financial officer, Robert Hull (pictured) said the $US530 million non-cash impairment charge included the cumulative impact of the strengthening US dollar over the life of the investment.

“We are working our way through that process and expect it to be completed in the next month or so,” Hull said.

“The valuation is based on our best estimate of our one-third interest in the joint venture. This valuation is subject to potential adjustment as additional information becomes available as we complete the process,” he said.

Lowe’s, which released its full-year accounts reported that for the year ending January 29 its portion of losses flowing from Masters for the period hit $US61 million, up from $US57 million for the previous corresponding period.

Lowe’s told its investors it would be forced to report a $US530 million non-cash impairment charge based on the cumulative losses flowing from its stake in Masters and its best estimate of the value of its portion of the joint venture.

The impairment is subject to possible adjustments agreed to a price to buy back its one-third stake in Masters as Woolworths prepares to sell the chain or close it down completely.