The 2023-24 Federal Budget announced by Treasurer Dr Jim Chalmers on Tuesday incorporates a range of tax and superannuation related measures with a focus on small business and investment in housing. It also aims to ease pressure on households with power bill savings, boosts to bulk billing incentives and an increase in rent assistance, among other measures.

But what does this mean for the retail sector? Will it be enough to restore consumer confidence? Appliance Retailer spoke to several industry retailers to hear their response and outlook for the remainder of 2023.

The cost-of-living crisis is having a significant impact on retailers, but the latest budget appears to be trying to ease some of that burden for Australian families, according to Spartan Electrical marketing manager, Ryan Burgess.

“Will it succeed and will retail feel the benefit of that anytime soon? Unfortunately, I doubt it,” he told Appliance Retailer.

“It’s a tough market across the board and we’re hearing it from all suppliers. We’re in the fortunate position that we’re maintaining market share; particularly around campaigns, we’re seeing strong demand for genuine offers.”

Burgess expects second half to be business as usual with its annual pillar campaigns forthcoming. “We’re recruiting for a new admin role which will alleviate some stress and burden from our sales team, in addition to expanding our sales team with a new salesperson based at our Torrensville store.

“We’re cautious but optimistic and working strategically to retain and grow our market share by providing genuine offers with outstanding customer service experiences. We’re investing more than ever before in our showroom experiences and will continue to provide a premium retail offering for our customers.”

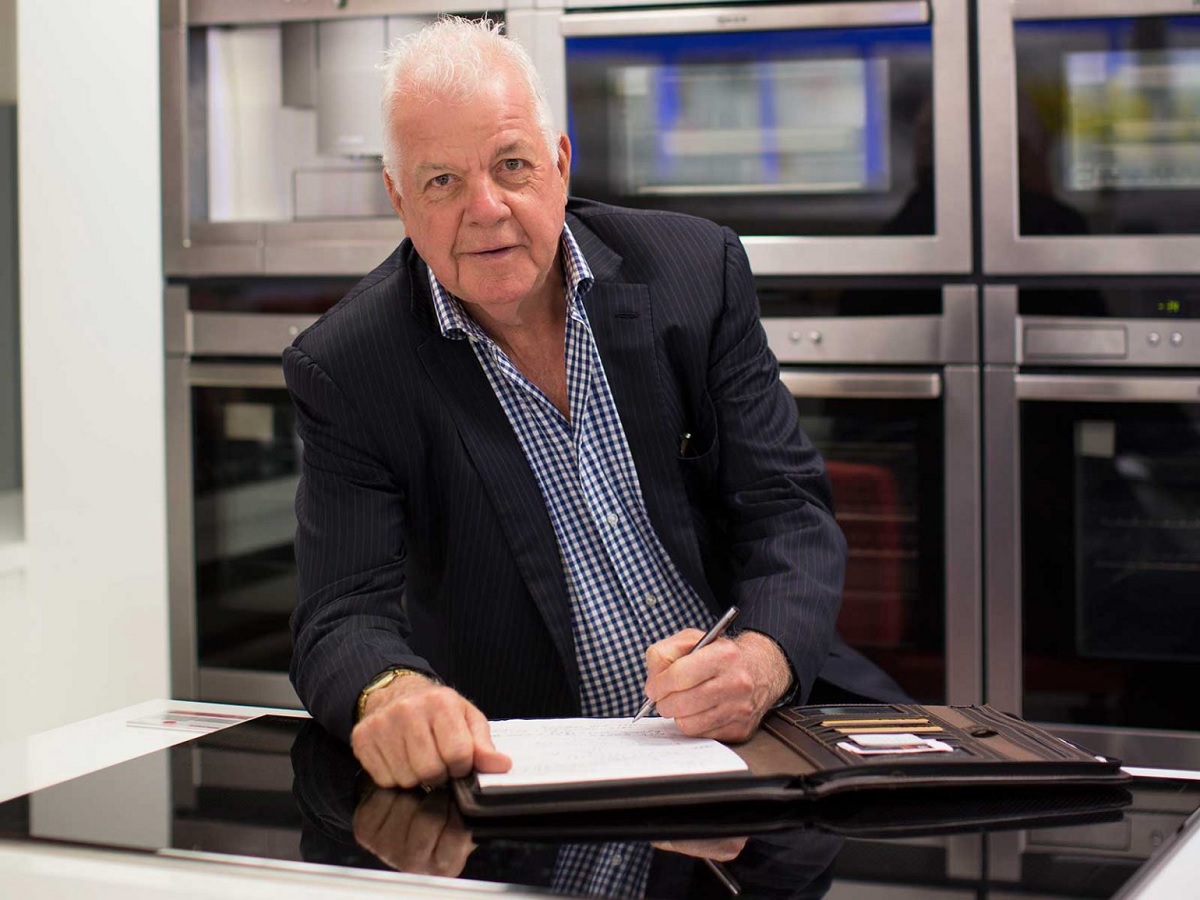

Hart & Co executive chairman, Rick Hart doesn’t believe the Budget provides much for business. “I doubt it will do much or curb inflation, despite their prediction. Overall, it seems to be a budget for the battlers, which is okay,” he told Appliance Retailer.

“The current environment is challenging at best. Consumers have concerns with interest rates and inflation, creating uncertainty and therefore, conservative buying patterns. My view is that the next year or so will continue to be challenging. The aforesaid issues will continue to affect trading conditions. Consumers need a big boost of confidence to let go of the purse strings and it’s hard to see that coming for a while.”

Leading Edge Group (LEG) general manager of retail, Charlie Davey says the budget highlights the challenges associated with an increase in cost-of-living.

“The government’s focus on small businesses through tax relief in energy efficiency and electrification investments, $20,000 instant asset write-off and power bill rebates will help small independent retailers to reduce their costs,” he told Appliance Retailer.

“The Small Business Energy Incentive will have positive impacts for both retailers and the environment. We were also pleased with the establishment of the Industry Growth Program to support Australian SMEs and startups to commercialise their ideas and grow their operations.

“In supporting families and team members involved with our members stores, we were pleased to see the commitment to cut the cost of childcare for 1.2 million families. This will benefit our retail teams and the broader economy to ease some of the cost-of-living pressures.”

LEG expects to see continued growth in its appliance group over the second half, particularly in everyday essential items. “We do expect slightly tighter conditions in the high-end market, which may reflect some downgrading due to a tighter economy and less disposable income.”

Retailers like digiDirect thrive when discretionary spending is high, but shopping appetites are softening, according to general manager, Haig Kayserian.

“This is why it’s welcoming to see the government’s budget delivering relief for people and businesses who are struggling most. Their plans to lift bulk billing rates, increase welfare payments and discount energy bills should put some money back into consumer’s pockets. As a company expanding our B2B operations, digiDirect hopes the $20,000 instant asset write-off extension will stimulate spending from business,” he told Appliance Retailer.

“Whether these measures are enough to offset the proposed tax increases and likely continuation of inflationary pressures on interest rates, which are things we are less enthusiastic about, remains to be seen.

“We have had to navigate this climate by offering increased value to customers, who are also costing more to acquire due to cost pressures extending their consideration process. We expect the Budget to help stimulate our activities during tax time and leading into the end of financial year. Beyond that, we are confident digiDirect’s size and agility will help us navigate the uncertainties of whether the other side of June is a slight ramp down or up, a cliff or an orchard.”

Videopro CEO, Cameron Douglas has observed a slowdown in foot traffic and enquiries, as well as a far more competitive trading environment.

“That being said, we’re seeing a lot of customers flock to quality and known brands instead of the typical narrative that customers choose cheap in a downturn,” he told Appliance Retailer.

“The budget is looking to address hardship, so this could be a positive for retail across the board; however, it might not move the needle on discretionary retail. Taking all of this into consideration, there are still a number of socioeconomics not being impacted by high interest rates and the unemployment rate is still very low.

“We’re cautiously optimistic about the future, and while it might look different to the last three years, it’s important to note that they weren’t a walk in the park either. We have a new set of rules, but it’s still the same game.”