This year’s Budget has painted a grim long-term economic outlook with high global uncertainty and rising inflation continuing to put pressure on businesses and households. Appliance Retailer contacted several retailers around the country for feedback on the Budget announcements and predictions for the upcoming sales season.

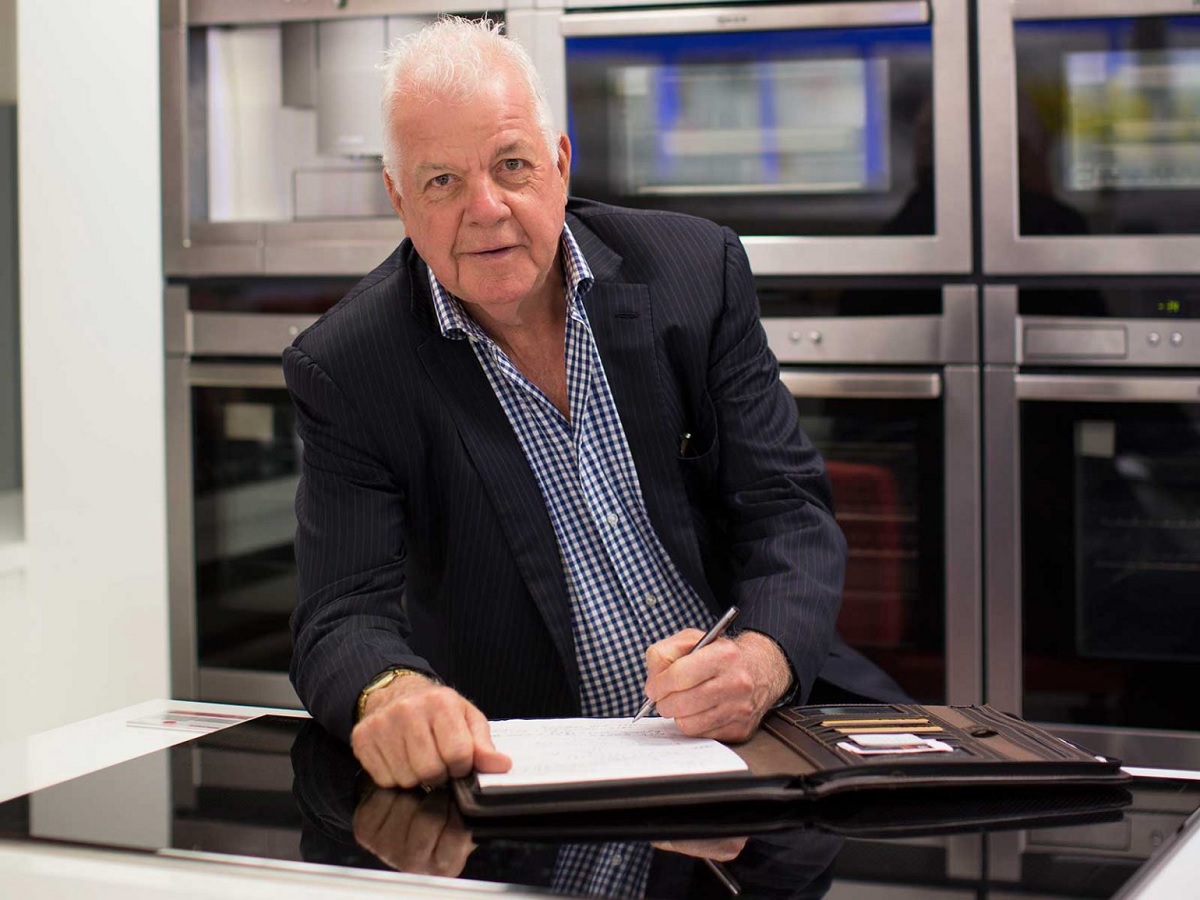

Hart & Co executive chairman, Rick Hart doesn’t see ‘joy’ for retailers in the Budget.

“It looks to me to be a bit of a stop gap measure until the May Budget. We’ll see how the building injection helps but I’m not expecting much from that,” he said.

“I expect business performance leading up to Christmas to be reasonably buoyant. Consumers have a habit of putting bad news behind them at this time of year and going about their buying unhindered. Interest rates continue to be the elephant in the room for retail and it seems we will face more pain in that regard in the next couple of months, which will be the biggest dampener on retail looking ahead.”

Status Plus director, Ashley Balderson shared a similar sentiment, expecting the economy to derail in 2024.

“With power bills increasing by up to 50% in the next six months and further rises shortly after, blaming the war on Ukraine for no gas is a cop out. This coupled with the fact that regional areas are not benefitting from the budget, I expect 2024 to be an ugly train wreck,” he told Appliance Retailer.

Rawsons sales director, Jon Pysing agreed there isn’t much in the Budget to assist retailers as the economy moves into troubled waters.

“Any small gains that households may receive will be spent on necessities rather than luxuries,” he told Appliance Retailer.

“We anticipate the lead up to Christmas to be quite subdued with of a bit of an uptick around Black Friday weekend. Value will be the key to sustaining a level of business and we expect good brands to stay strong and weaker no name brands to suffer a greater downturn.”

digiDirect general manager, Haig Kayserian said the macroeconomic data revealed by the treasurer was a sobering reminder of the difficulties the economy is facing as part of the greater global economy.

“However, the forecast peak of inflation at 7.75% is not as bad as many other countries. Similarly, the forecast slowdown of the economy was probably expected to be a lot worse than down to 1.5% growth over the next financial year,” he told Appliance Retailer.

“For retail to thrive, we need more money in people’s pockets. The fact the government resisted the temptation to hand down a populist Budget full of unfunded handouts, which would have increased inflationary pressures on the economy, is positive for a retail industry that wants the inflation index to go down sooner, taking interest rates down with it, resulting in more money into people’s pockets.

“For digiDirect in particular, we are encouraged by this Budget’s increase in spend on the NBN, which promises to deliver faster internet to more Australian households. We think increased access to faster internet will boost consumer spending on the categories we specialise in for professionals, gamers and content creators.

“The economic headwinds projected means increased pressure on consumer spending this sales season across November and December. Retailers that provide value to customers, as well as service with available stock, will be best positioned to earn sales,” he added.

“digiDirect has planned inventory and staffing, as well as constructed deals with suppliers to ensure we provide the right value and service to our customers over the forthcoming two months, and we are therefore confident of achieving our projected numbers.”

Videopro CEO, Cameron Douglas believes the budget paints a far more conservative view of future trading conditions, however there are still factors contributing to optimism in the coming Black Friday and Cyber Monday period.

“While travel is back, it is expensive and often unreliable and with the general cost of living going up there is still a lot of reasons to invest in home entertainment and home appliances. While the budget talks to tougher times ahead, I don’t think this paints any new ideas to the current consumer sentiment and we see most of this thinking baked into the current trading conditions,” he told Appliance Retailer.