Four years after leaving Garmin Australasia to return home to Missouri, where the tech giant’s head office is found, Matt De Moss has returned to the local subsidiary, stepping back in to general manager role.

When he first came Down Under in 2008, Garmin was based in Seven Hills, in inner west Sydney, and had 30 employees. During the great sat nav boom of the 2000s, the company grew to 50 staff, becoming a market leader in in-car, marine, aviation, fitness and golf personal navigation devices. He left Australia with his wife and young son in 2010, lured back to Garmin’s Kansas City base to lead up the brand’s expansion into Central and South America. He established wholly owned subsidiaries in Brazil, Argentina and Chile; and oversaw the buyout of Garmin’s licenced distributor in Mexico.

De Moss says Garmin’s overseas strategy melds two principals: mature vertical integration from the head office down to the end user, coupled with a degree of autonomy in each region, so a subsidiary can be more than simply a sales and marketing company. “Garmin subsidiaries should have their own people, their own ideas and their own roots,” he says, somewhat lamenting that in his absence, Garmin relocated to a purpose built head office and warehousing facility in Eastern Creek, in the western outskirts of Sydney.

The biggest change for Garmin in De Moss’ absence has been the decline of in-car personal navigation devices, or GPSes as were generally known. During the 2000s, Garmin competed fiercely with Uniden, TomTom, Navman, Navigon, Magellan and several other brands for a piece of this sizable pie. The penetration rate grew quickly, leading to commoditisation, and then smartphones’ mapping capabilities matured to the point where many drivers were more than happy using an iPhone or Android device for their guidance.

The navigation decline has been so steady and unrelenting that De Moss declared that 2015 will be the year that wearables overtakes personal navigation as Garmin biggest seller, both in terms of units and value — back in 2008, that would have been considered a seismic turnaround. This is not say that Garmin doesn’t care about this market — De Moss went to great lengths to stress that some very attractive models were coming to Australian market this year — but focus is now squarely on fitness bands and smartwatches.

In April last year, at a trade presentation in Belek, Turkey, Paul Gray from DisplaySearch, the global leader in display research, said activity trackers were well-placed to grow in the latter half of the 2010s because there is a “compelling social need to increase activity levels”, and he cited worldwide obesity and inactivity levels as proof of this. Whilst Australia’s obesity levels is around 10 per cent, according to Gray’s research — low compared to comparable Western countries (the United States leads the way at around 37 per cent) — our inactivity levels are quite high: around 35 per cent.

Garmin is seizing these inactivity stats are, like their customers, running with them. “Sitting is the new smoking,” said De Moss, pointing out that the new VivoSmart band vibrates if the user has been sitting down for too long. “Just to remind you to get up and have a walk around the office,” he said, and it’s an effective system, according to Paul Gray.

“Activity trackers and smartbands are surprisingly motivating,” Gray said. Because fitness enthusiasts have a “love/hate relationship” with their smartphone, the devices that can operate free of a handset can bridge the gap, while running, between tracking and monitoring exercise and freedom from a cumbersome piece of technology.

(On a cynical whim, I put “sitting is the new smoking” into Google and found that this is quite an established line of thinking, with many articles from reputable sources, and England’s Mirror, supporting this assertion.)

Wearables is certainly the buzz category of the moment, with smartphone brands like Sony, Samsung, LG and Motorola releasing units to complement the dedicated fitness devices from Fitbit and Jawbone and the models out of traditionally navigation brands like TomTom and Garmin. De Moss sees a real advantage to being at arm’s length from the smartphone players because Garmin’s bands and watches are brand agnostic. Unlike the Android Wear devices that only work with Android phones, Garmin’s will work with both a Samsung Galaxy S5 and an iPhone 6 (along with Windows Phone too, for what’s it’s worth). Once connected over Bluetooth, the devices can display notifications from all apps, and you actually read messages, rather than simply know they have arrived, on the band or watch. This flexibility is essential if wearables are going to truly become a mainstream category, rather than a small niche among gym junkies.

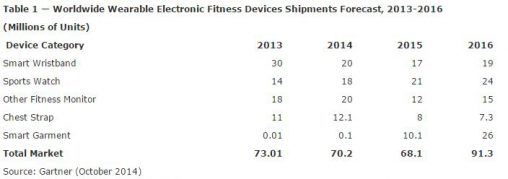

For those hoping these gadgets provide a silver bullet to slow sales, Gartner provides some sobering news. In a November 2014 report, Gartner said Smart Wristband sales are expected to decline in 2015, from 20 million global unit sales in 2014 to 17 million this year, before rebounding to 19 million in 2016. Growth is going to be focused is Smart Watches, from 18 million units in 2014 to 21 million (2015) to 24 million (2016). (Interestingly, Gartner projects the most astounding growth to come in Smart Garments – otherwise traditional pieces of clothing embedded with a tracking device — from 100,000 units in 2014 to 26 million in 2016.)

Gray is another who cautions against the industry becoming too wrapped up in its own hype when it comes to wearables. He points out that Samsung is currently onto its fourth attempt at kickstarting the craze, having been party to flopped attempts since the late 1990s.

A big boost to wearable sales is expect to come following the launch of Apple’s Watch in late April 2015. Apple itself is expected to sell around 30 million units but this is just a fraction of how many users it will to the market with its highly anticipated marketing spend. While there is a large community of consumers who will only buy the Apple product, there will be others who are introduced to the category through Apple’s launch and campaign but are either priced out of the Apple Watch of looking for differentiated functionality. The same principle applies, though to a lesser extent, for the aforementioned Android smartphones brands.

“Our goal is not to compete with the smartphone but to interact with the smartphone,” De Moss said.

Garmin’s 3-pronged attack on wearables in 2015 includes the VivoFit 2 (from RRP $139) Vivo Smart bands (from RRP $199) and the Vivo Active smartwatch (from RRP $329). In addition to telling the time, these models work with bespoke apps to monitor and track running, cycling, swimming, golfing and various other activities. Models are also available with heart rate monitoring, which carries a premium on the stated RRPs.