To two-year low.

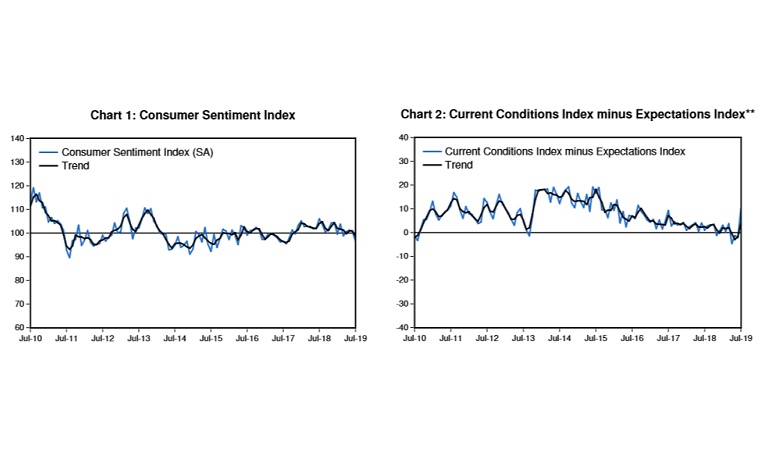

The Westpac-Melbourne Institute Index of Consumer Sentiment fell 4.1% to 96.5 in July from 100.7 in June, despite a further interest rate cut from the RBA, the Federal government’s tax package pass through Parliament, stabilisation of the Sydney and Melbourne housing markets and more improvement in the US-China trade dispute.

Westpac senior economist, Matthew Hassan said the fall in sentiment this month is troubling as it comes against what should have been a supportive backdrop for confidence.

“The main driver continues to be deepening concerns about the outlook for the Australian economy and prospects for family finances,” he commented.

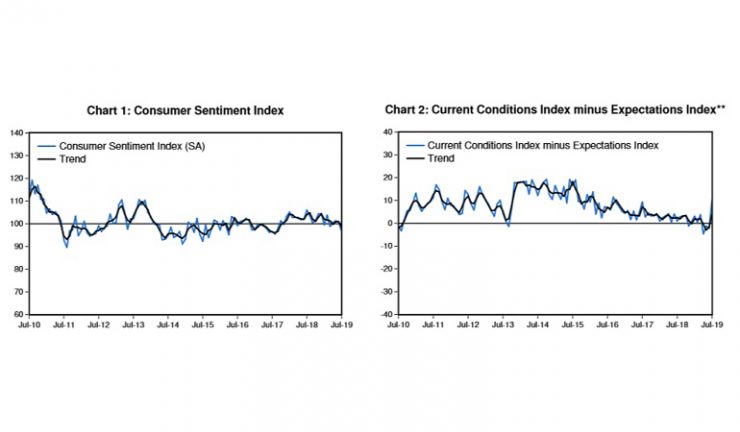

The index components show the biggest decline in the sub-index tracking expectations for the ‘economy, next 12 months’ which slumped 12.3% to be down 16.4% since May to its lowest level in four years. Longer term expectations for the economy were also pared back sharply, the ‘economy, next 5 years’ sub-index falling 6.7%.

“Deteriorating expectations for the economy outweighed any near term support from the prospect of lower interest rates and tax relief. The sub-index tracking consumers’ expectations for ‘finances, next 12 months’ also recorded a sharp 8% fall, moving back into net pessimistic territory for the first time since late 2017.”

Consumer views around current conditions were better supported. The ‘finances vs a year ago’ sub-index lifted 3% to a five month high, although at 85.7, the sub-index remains at weak levels overall. Consumer attitudes towards spending also improved, the ‘time to buy a major household item’ sub-index rising 3.6% to the highest level since late last year.

The Reserve Bank Board next meets on August 6 and Westpac expects the Bank to leave the cash rate on hold at this particular meeting but see further easing coming later in the year.

“Having delivered back to back 25bp cuts in June and July, the Reserve Bank has signalled that it is prepared to ease further “if needed”. Updated forecasts released in the August Statement on Monetary Policy, due August 8, will give the best guide to how the RBA sees the case for further policy action. At this stage it seems likely that the Bank will make only minor changes to its growth and inflation forecasts, suggesting policy will be unchanged at the August meeting,” Hassan said.