Takes a giant hit from coronavirus.

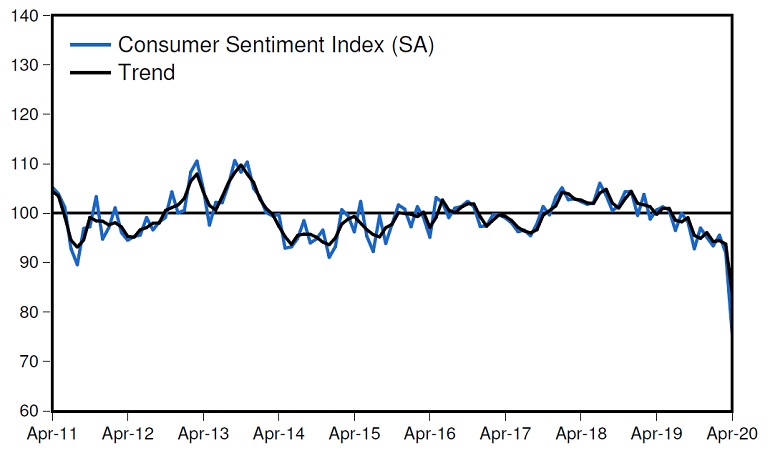

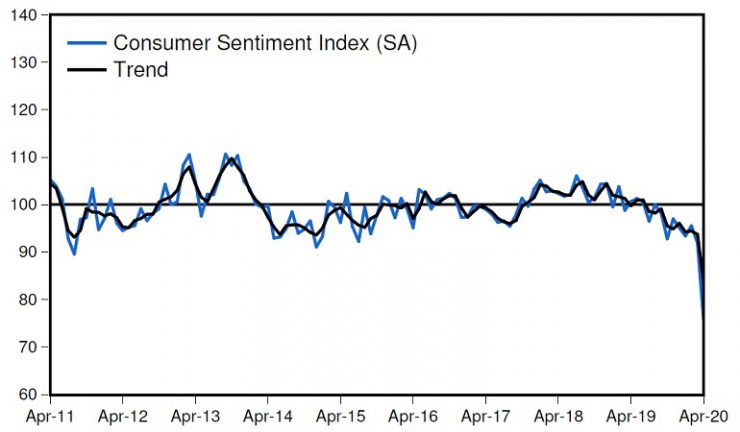

The Westpac-Melbourne Institute Index of Consumer Sentiment plunged 17.7% in April, its single biggest monthly decline in the 47-year history of the survey.

The crash takes the index beyond GFC lows to levels only seen during the deep recessions of the early 1990s and 1980s, Westpac chief economist, Bill Evans said. “However, the lows in previous recessions were reached after one to two years of continuous deterioration compared to the one month collapse we have seen here.”

All five component sub-indexes fell in April. By far the biggest falls were in the near-term outlook for the economy and in attitudes towards spending, reflecting the immediate effects of the shut-down.

Evans said while this represents the large shocks to jobs and spending, the most surprising message was the collapse in confidence in the housing market. And component-wise, the biggest drop was felt in the ‘time to buy a major household item’ sub-index which posted a 31.6% plunge, the sharpest on record. “This was the lowest reading since the record low set in October 2008, and signals very difficult times for retailers selling major household goods,” he said.

The ‘time to buy a dwelling’ index dropped 26.6%, the biggest monthly decline on record.

The survey comes after an extremely turbulent month in which the coronavirus outbreak evolved from serious concern to full-blown pandemic, and while the drop in confidence this month was severe, it could well have been worse, Evans said. “Australia’s pandemic experience to date has been much less debilitating than that of the hardest hit areas abroad. The number of cases is high but has not overwhelmed our health system, with recent evidence showing a clear slowing in new cases that indicates policy measures are working to contain the spread. These developments give some support to our view that the economy will lift in the December quarter following three consecutive quarters of economic contraction.

“We have also seen a swift and effective response from governments, highlighted by the government’s $130 billion JobKeeper payment scheme. Westpac estimated that without this the unemployment rate would have soared to 17% by the end of June compared to a peak of 9% with the payment scheme.”

The Reserve Bank Board meets on May 5 with the bank also due to release revised economic forecasts in its May Statement on Monetary Policy on May 8.

According to Evans it is likely that the Board considers it has done its duty to support the economy and will now look to governments if further support for the economy is required.