Breville CEO Jim Clayton has revealed an internal efficiency project known as ‘Launch 2.0’ is “pouring fuel on the fire” for the company’s NPD rollout.

Speaking during the company’s half-year results, Clayton claims the new launch process is critical as the company navigates the volatile supply chain environment globally

“When we launched the Barista Express this year, we used a new launch process called ‘Launch 2.0’. To help you understand the step-change improvement this new process has delivered, I have set-up an analytic drag race between the Barista Pro – which was launched under the old process, and the Barista Impress,” Clayton said, pointing to a number of slides to demonstrate the benefits of the new efficiency strategy.

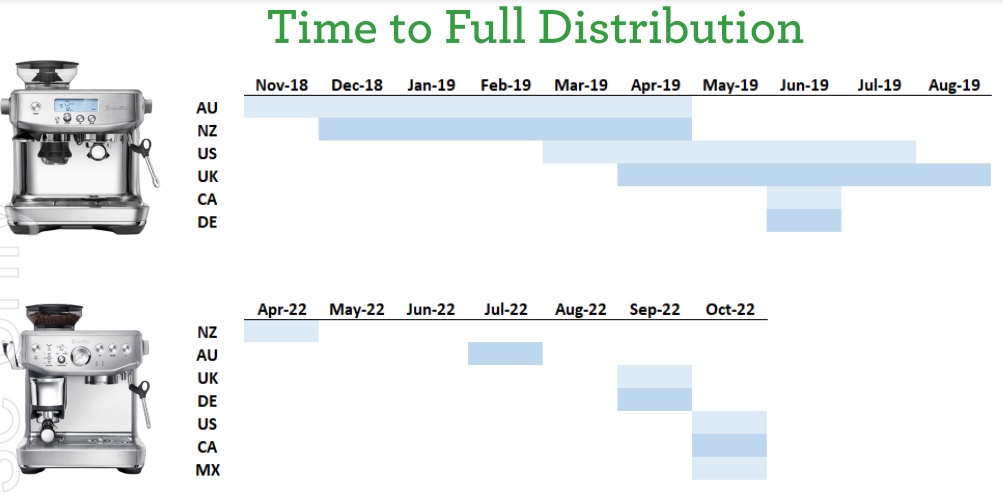

“As luck would have it, [the Barista Pro and the Barista Express] are at very similar price points, neutralising the elasticity variable. At the highest level, there are two main differences between the launch processes. Firstly the elapsed time from the first country launch to the last and secondly go to market approach within a country. In this example, Launch 2.0 cut three months off the total launch time which is a revenue accelerator. The major driver for shortening the total launch time is inventory position.

“In Launch 1.0 we’d launched in the first country and begin to ramp production to support the existing country and the next With Launch 2.0 we built material inventory ahead of time to support a ‘Big Bang’ launch in each country. This played a role in our FY22 inventory number and is embedded in our first half 2023 inventory number for a SKU launching in the second half of FY23.

“Looking at the country level on this chart, you can see a difference in the width of the launch bar. Picking Australia as an example, the Barista Pro went into the first retailer in November of 2018. The last retailer in Australia however, did not receive the new products until April 2019. The production ramp approach drives this incremental step by step rollout.

“In Launch 1.0 the burden of marketing the new product falls on Breville alone supporting the product throughout the retailer rollout. In Launch 2.0, Breville and all our retail partners are marketing the new products on the same day, giving a leveraged effect on our marketing spend. In theory, this should accelerate the numbers of consumers evaluating the new product versus the Launch 1.0 approach. And let’s see if that happened.

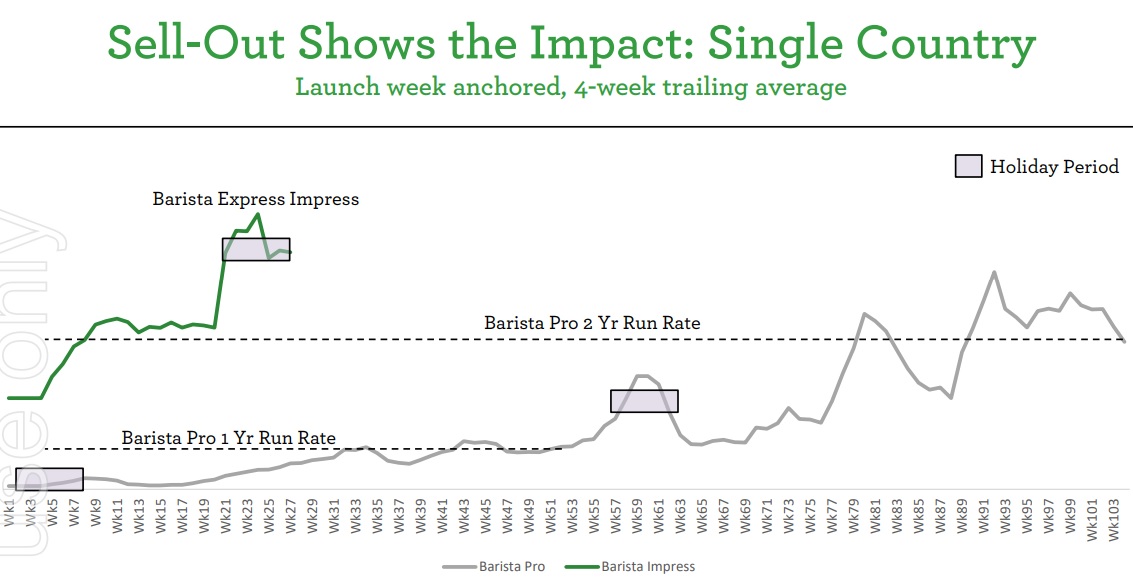

Clayton then presented another slide that displayed the four-week trailing average of the weekly sell-out data of the Barista Pro and the Barista Impress in a single country.

“Both curves are anchored on each product’s first week of launch. This means we are apples to apples on time in market but we are not aligned against seasonal patterns because they launched in different months – I have highlighted the core Christmas window in purple for each. With the Barista Pro, it launched in its first retailer and steadily climbed for two years. At the end of the second year it hit its run rate for future years. A proxy for the revenue we reported for the Barista Pro from this country is the area under the grey line.

“I say ‘proxy’ because this is sell-out data not sell-in. With the Launch 2.0 process, the Barista Impress came online quickly and may have reached its long term run rate seven weeks after launch. Two quick footnotes – the flat area on the left side of the curve is a function of using a four week trailing average and the spike is driven by the holiday season.

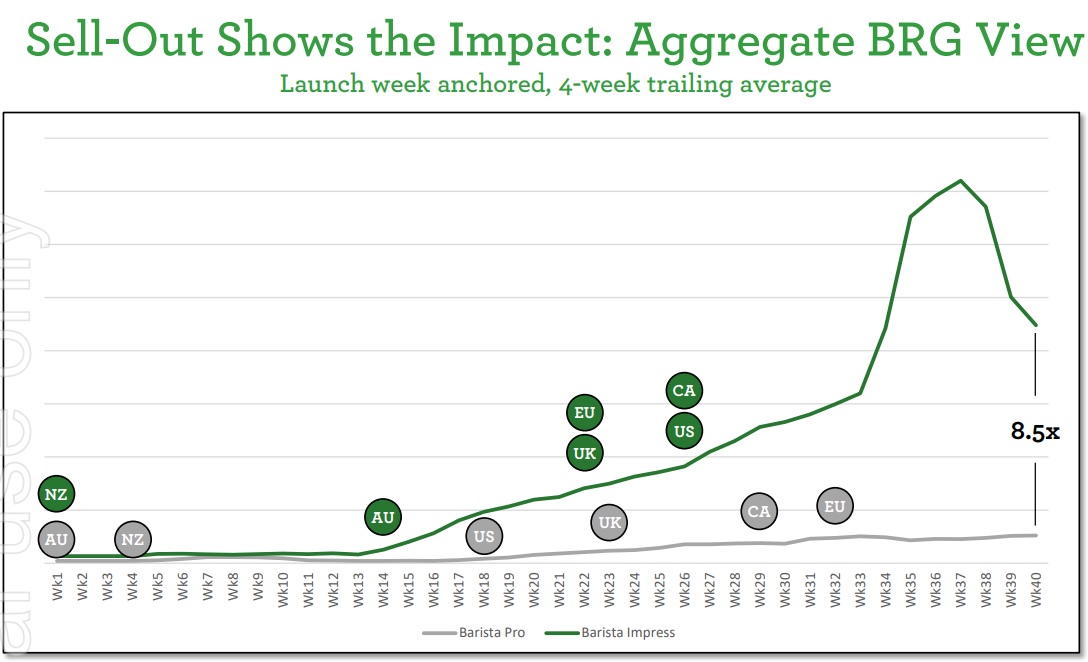

“On the next slide, looking at the aggregate sell out data across all markets, you can see the combined impact of countries launching more quickly coupled with the accelerated path to run rate for the products. This chart shows you the four-week trailing average of the aggregate weekly sell out data for each product with those products anchored on the first week of launch. I’ve also included an indication of when each country came online. By the 40th week after launch, the Barista Impress had a weekly unit sell-out that was 8.5 times larger than the Barista Pro.

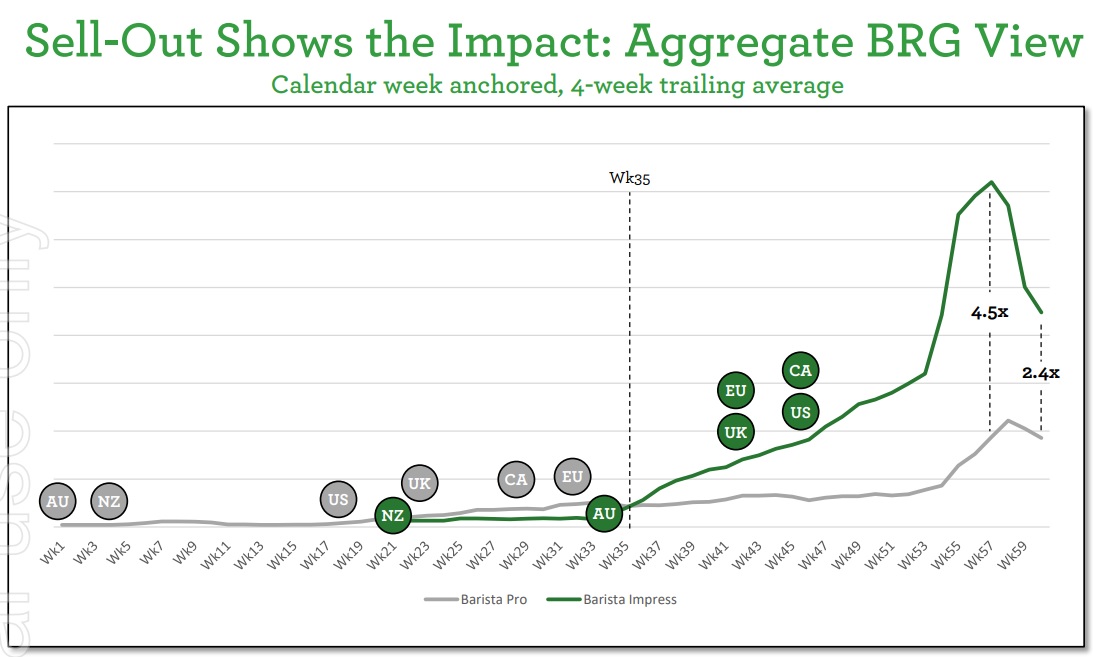

“In the last two slides, I ran the analytic drag race based on each product having an equal time in market. If instead I cut the database on the calendar year, we can normalize out seasonality. So the Barista Pro will be advantaged because it has more time in market. In this race, the Barista Pro has a five-month head start. Focusing in on Barista Pro’s 35th week from launch, you can see that by this time Barista Pro had launched in at least one retailer in all countries. Yet with Launch 2.0, the Barista Impress had a higher weekly unit sell-out having only launched in Australia and New Zealand.

“We saw a 4.5x delta at the peak and a 2.5x delta exiting the half. No matter how I cut the data, I’m seeing the new Launch 2.0 process as a material improvement in our acceleration program. If NPD is a core strength then the Launch 2.0 process is pouring fuel on the fire.”