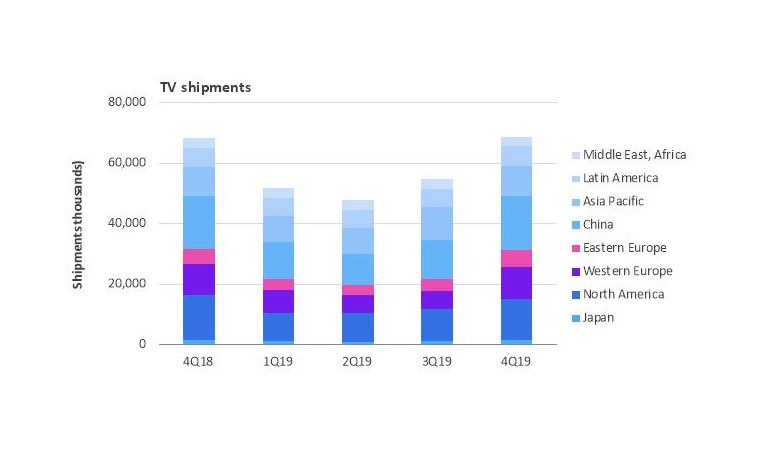

The global television market managed to attain slight growth in Q4, 2019 despite trade barriers and weak demand from major markets. Easing in a shortage of LCD panels helped propel the market’s expansion too, according to research group Omdia. Global TV set shipments in the quarter rose 1.5% with shipments rising 0.7% for the year.

“If there ever was a year that the television market would be expected to suffer a decline, it would be 2019, when the global industry faced a range of business, economic and trade challenges,” Omdia research director, Paul Gray said. “TV makers in 2019 contended with major issues including trade tariffs and weak demand from important regions. Despite that, some TV makers managed to find growth by capitalising on low LCD panel prices and tapping into new regions.”

In terms of features, almost 60% of sets shipped in Q4 had Ultra-High Definition (UHD) resolutions, with demand coming from North America, Western Europe and China. Only Asia-Pacific and the Middle East and Africa had a UHD shipment share of less than 50% due to consumer preference for smaller (non-UHD) screen sizes.

According to Gray, TVs with 8K resolution remain a novelty for consumers, with their high prices and scarcity of content weighing heavily against growth.

When it comes to display technology, Organic Light-Emitting Diode (OLED) televisions returned to strong growth in Q4. However, quantum dot LCD TVs (QD-LCD) posted an even larger expansion, rising by 90% quarter-on-quarter due to robust shipments from Samsung. QD-LCD shipments were more than double those of OLED.

Rapid price declines for LCD panels represent an existential challenge to OLED displays, Gray said. “OLEDs don’t enjoy the same manufacturing cost structure that LCDs have. Meanwhile, Samsung’s QD-LCD technology is allowing the company to compete head-to-head with OLED TVs while capitalising on declining prices for LCD panels.”