Retail sales look to end 2019 on a relatively soft note as consumers face increasing budget pressure, according to Deloitte Retail Forecasts principal author, David Rumbens.

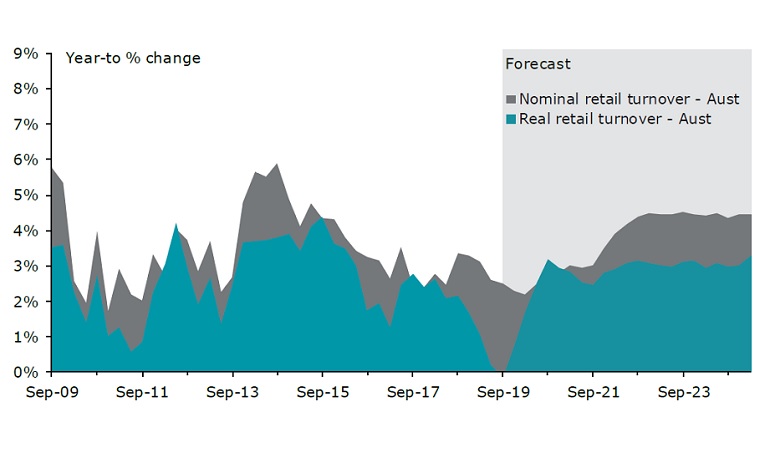

“Stagnating wage growth and weak house prices have limited consumer willingness to spend, while tax offsets and interest rate cuts have yet to translate to sales,” he said. “With retail prices increasing, spending volumes have taken the hit posting the weakest growth since the 1990s recession.”

The recent Deloitte Retailer’s Christmas Survey revealed that only 21% of respondents expect growth above 5% this year, down from 41% respondents last year. Retail price growth has consistently outpaced general price pressures in the economy for the first time since 2009.

“Unfortunately for retailers, price growth is not reflective of stronger demand, but rather increasing cost pressures from a weaker Australian dollar, the increase to the minimum wage, and supply disruptions from droughts and floods. With retailers being squeezed on both sides from weak sales volumes and increasing costs, margins are coming under pressure.”

However, retail spending is expected to pick up in 2020 with growth of 2.6% over the year.

“We expect to see a much-needed improvement in the drivers of spending, providing the environment for a turn around the weak retail demand profile in 2020. Stronger wage growth, a reinvigorated housing market and moderating price pressures are expected to support a much stronger growth outlook in the year ahead.”