Christmas outlook remains downbeat.

The Westpac-Melbourne Institute Index of Consumer Sentiment rose 4.5% in November, following a sharp 5.5% fall in October.

The lift in consumer spirits may be from the possibility of the government bringing forward the personal income tax cuts legislated for July 2022, to July 2020, Westpac chief economist, Bill Evans said.

“Other factors would have also boosted consumer sentiment since the last survey, with a more positive tone around the global economy. The key here will be whether the US and China are able to reach a successful agreement on the trade disputes. Markets are now likely to be already pricing in a satisfactory outcome to the current discussions,” he said.

However, consumer attitudes towards spending look to be downbeat heading into the all-important Christmas sales period. “The ‘time to buy a major household item’ sub-index rose 3% in November but is still 4% below its August level, suggesting consumers will be keeping a tight rein on discretionary spending.”

A restrained attitude towards spending was evident in responses to annual question on Christmas spending plans with one in three Australians planning to spend less on gifts than they did last year, with 54% expecting to spend about the same. “Just 11% of consumers are planning to spend more this year. The mix is almost identical to last year’s survey and suggests we are heading for another lacklustre Christmas spend,” Evans said.

Housing-related sentiment was also relatively stable in November with views on time to buy improving slightly but price expectations were showing signs of consolidating after strong gains in previous months.

The ‘time to buy a dwelling’ index rose 2.1% in November, but buyer sentiment continues to soften in NSW and Victoria where the resurgence in prices already looks to be squeezing affordability. Buyer sentiment remains relatively well supported in Queensland, WA and SA.

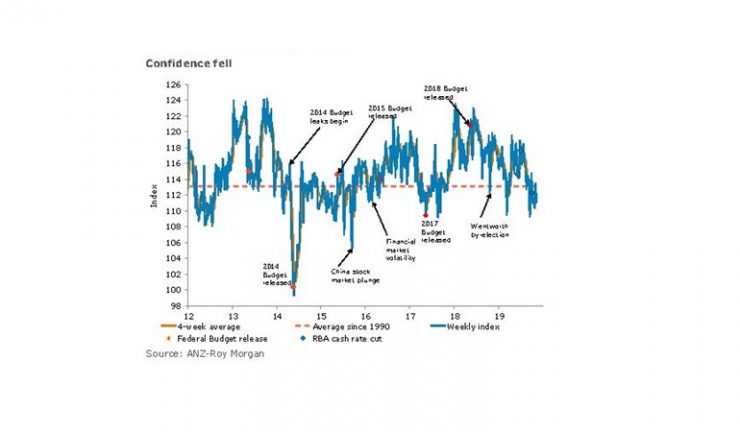

It was however a different set of numbers coming from the ANZ-Roy Morgan Consumer Confidence index that made a U-turn last week. It fell 2.1% with all sub-indices in the negative, except future economic conditions while the ‘time to buy a household item’ indicator continued its see -saw pattern, falling 3.9% after a gain of 1.3% last week.

ANZ head of Australian economics, David Plank, described the fall in consumer confidence as “a bit disappointing”. This was despite strengthening global macroeconomic conditions and some reasonable domestic news in the form of a huge trade surplus and continued good news on housing, he said.

“These data points were clearly not enough to offset a fall in the volume of retail sales for the September quarter, the first drop in annual retail volumes since the early 1990s recession, and a softening in ANZ job ads. The defining feature of the survey remains the divergence between financial and economic conditions.”