Lowest level in over four years.

The Westpac-Melbourne Institute Index of Consumer Sentiment declined 5.5% in October, its lowest level since July 2015.

This result will be of some concern to the monetary authorities, Westpac chief economist, Bill Evans said. “Typically, an interest rate cut boosts confidence particularly around consumers’ expectations for and assessments of their own finances,” he said.

Consumers are looking behind the reason for the rate cut and, arguably, the absolute level of rates and getting nervous. The Index has now been in the range where pessimists outnumber optimists for three of the last four months.”

Evans said global events have, again, contributed to the weak result in October with the deterioration in US-China trade relations weighing on the global economy amid speculation of a recession in the US, but these are unlikely to fully explain the sharp fall in the Index.

Issues that may also be unnerving consumers include the debate around the lack of response of fiscal policy to the deteriorating outlook and the realisation that wages growth is likely to remain ‘stuck’ at a modest 2% a year or less for the foreseeable future.

“All index components recorded material declines in October with consumer expectations for the economy recorded the biggest falls while assessments of family finances also took a heavy knock.

“Consumer attitudes towards spending also deteriorated in October. The ‘time to buy a major household item’ sub-index declined 4.2%, to a four-year low. Spending on discretionary and big ticket durable items has been particularly weak over the last year,” he said.

“Housing-related sentiment continues to show more mixed results with softer reads on ‘time to buy’ but more bullish expectations for prices suggesting affordability constraints may be starting to re-emerge.”

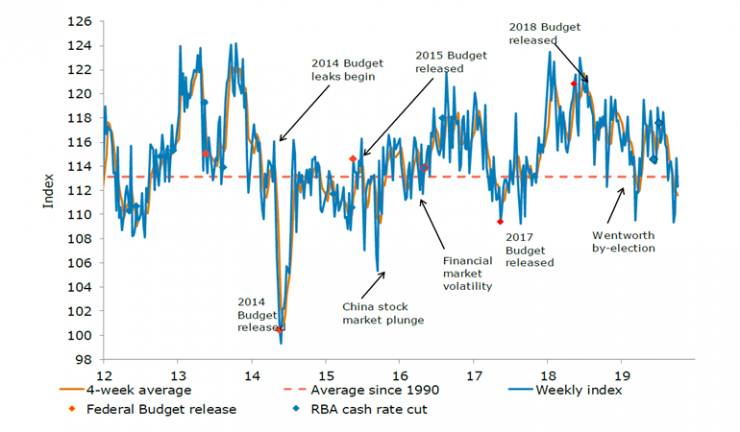

The latest ANZ-Roy Morgan index also showed consumer confidence in reverse gear, falling 2.1% last week, after gaining 4.2% in the previous week. All the sub-indices fell, except for the ‘major household item’ which continued to recover after falling to a 10-year low in recent weeks, but still remains below its long-term average.

Last week’s bounce wasn’t sustained, and sentiment has dipped below the long-term average, ANZ senior economist, Felicity Emmett said. “Ongoing concerns about the medium-term outlook are weighing down sentiment, although consumers continue to feel okay about their current financial circumstances.

“This divergence in thinking possibly explains the modest bounce in retail sales reported last week as consumers recognise the impact of tax and interest rate cuts on their budgets, but are worried about the outlook, so unwilling to splash the cash,” she said.

“The Reserve Bank is likely to be disappointed about the inability for either confidence or spending to lift materially, despite significant monetary and fiscal stimulus.”

Financial conditions sub-indices were down significantly and have been volatile for the last few weeks.