Good news for retailers.

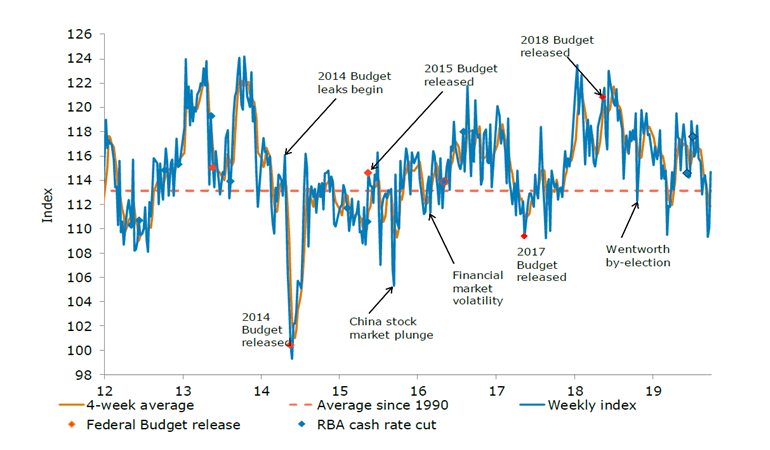

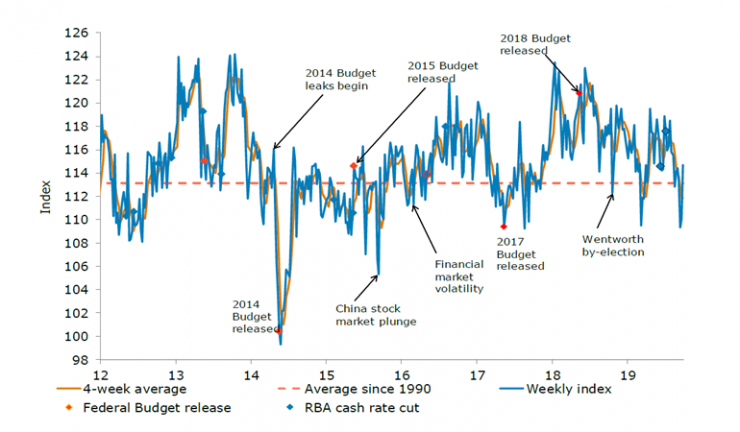

The seesaw in consumer confidence continued with a solid 4.2% rise last week, closing above its long term average, according to the latest data from ANZ-Roy Morgan. The financial and economic outlook remained strong with all sub-indices rising.

Retailers should be encouraged by a 7.1% jump in the ‘time to buy a major household item’. This followed a drop to a 10-year low last week, although the index sits below its long run average. Inflation expectations were unchanged at 4.1%.

Current finances were up 6.9% while future finances gained 5.9%. Both financial conditions indices remain above their long term averages. Current economic conditions rose by 3.5%, while future economic conditions jumped 5.7%. However, despite the jump, both sub-indices are below their long term averages.

This build on the modest gain from the previous week came despite ongoing geopolitical tensions and less than encouraging domestic data prints, ANZ senior economist, Felicity Emmett said. “It suggests that the early signs of a recovery in the housing sector and expectations of further easing by the Reserve Bank may be supporting consumer sentiment.”