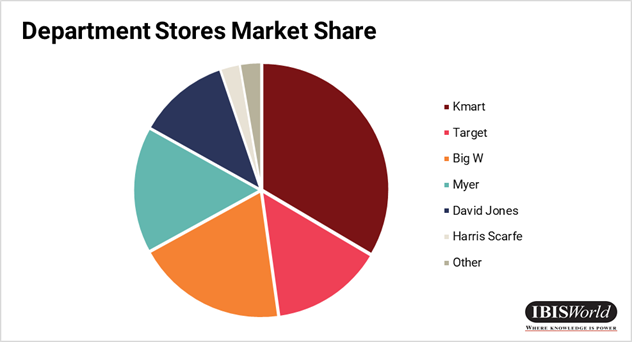

Among Australian retailers.

Falling revenue and profitability in the department stores industry has become a trend in recent years, but now the discount department stores industry is also being hit by the difficult economic environment, according to recent IBISWorld research.

IBISWorld senior industry analyst, James Caldwell (pictured) said Australia’s discount department stores have traditionally performed well in times of economic uncertainty. However, this appears no longer to be the case. “Big W and Target have struggled over the past five years, with their parent companies announcing the closure of several stores. Woolworths has announced that 30 Big W stores will close over the next three years. Wesfarmers has signalled an intention to close several Target outlets, shifting strategies to focus on Target’s digital platform.”

As a result, retailers are increasingly looking to one-stop shop business models that encourage consumers to use the same retailer for all their shopping needs.

Kogan.com officially launched Kogan Energy, offering electricity and gas services to residential customers in Victoria, New South Wales, Queensland and South Australia.

“Kogan.com has successfully expanded its retail offerings over the past five years, branching out into financial services, insurance and telecommunications. This strategy is paying off for the company, which has seen its revenue almost double since its launch on the ASX in 2016,” Caldwell said.

Kogan.com’s online rival Amazon is following a similar strategy, having recently announced the launch of its garden store in an attempt to challenge Bunnings’ dominance of the outdoor and gardening market. This new store has offerings targeted at the upcoming summer season, including pool supplies, outdoor furniture, barbecues and gardening tools. Amazon’s garden store is a continuation of the company’s attempt to become Australia’s one-stop shop for consumer goods, adding to its existing selection of household goods, groceries and clothing.

Other retailers pursuing the one-stop shop strategy include Coles and Woolworths, which offer a range of insurance, telecommunications and financial service products. German discount supermarket, Kaufland has announced its intention to enter Australia next year as a one-stop destination shop.

Despite the increasing trend towards one-stop shops, Australia’s major up-market department stores have shown little interest in following these models, Caldwell said.

“Both Myer and David Jones have signalled their intention to press ahead with their cost-cutting strategies. Myer’s chief executive recently declared the company needs revenue growth to remain profitable. Despite their difficulties, both companies have capitalised on consumers’ desire for convenience by increasing investment in their online operations.

“Online sales now account for 9.8% and 8.0% of total sales for Myer and David Jones respectively, having risen strongly over the past five years. Both retailers appear optimistic that they can continue to boost profitability and remain competitive, despite the increasingly challenging economic environment and the rise of one-stop shops.”