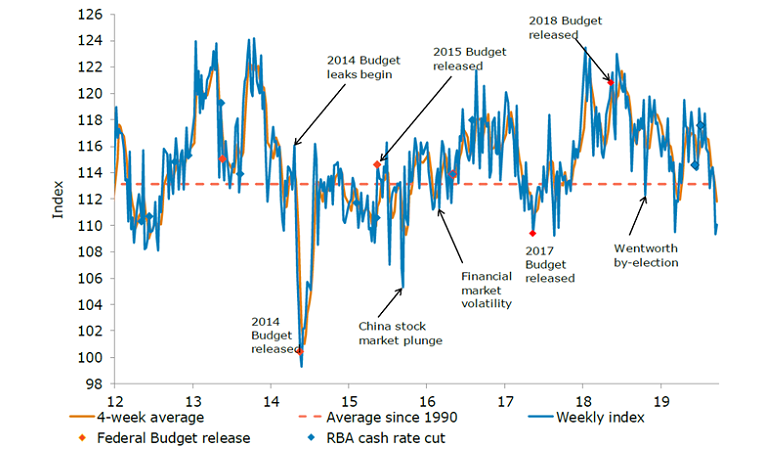

Lowest in a decade.

Consumer confidence gained 0.7% last week after losing 3.5% in the previous ANZ Roy Morgan reading, but household items buying intentions took a dive, dropping 3.8% to hit its lowest level in 10 years.

The modest rise in confidence leaves it well below its long run average, ANZ senior economist, Felicity Emmett said. “The weakness in the time-to-buy-a-household-item index is particularly disappointing, given that tax cuts should be supporting this measure.

“Rising concerns over the impact of the stimulus, combined with the lift in the unemployment rate in August and ongoing global easing in monetary policy settings, suggest to us that the Reserve Bank will likely cut rates again in October. So far, though, consumers seem impervious to both fiscal and monetary stimulus, and the combination of weak wage growth and high levels of debt may prove to be the more dominant driver of confidence and spending,” she said.

Current financial conditions gained 1.9% and remain above the long run average, while future financial conditions gained 1.6%.