Despite trade war, equity weakness.

Consumers were feeling more confident last week, particularly when it came to buying a household item, according to the latest Roy Morgan data.

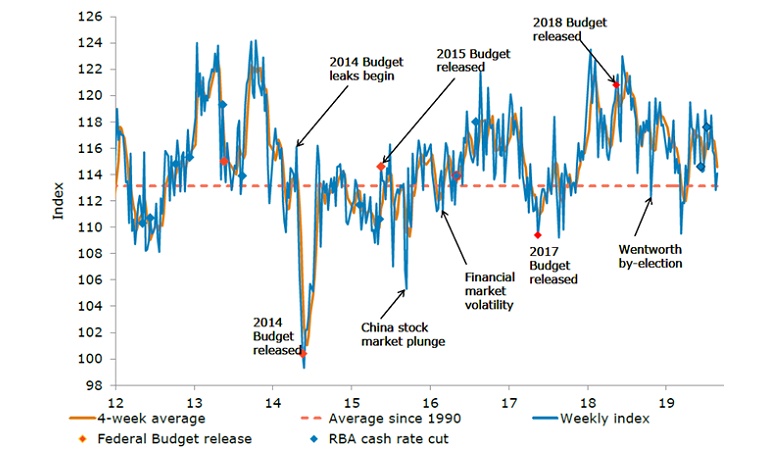

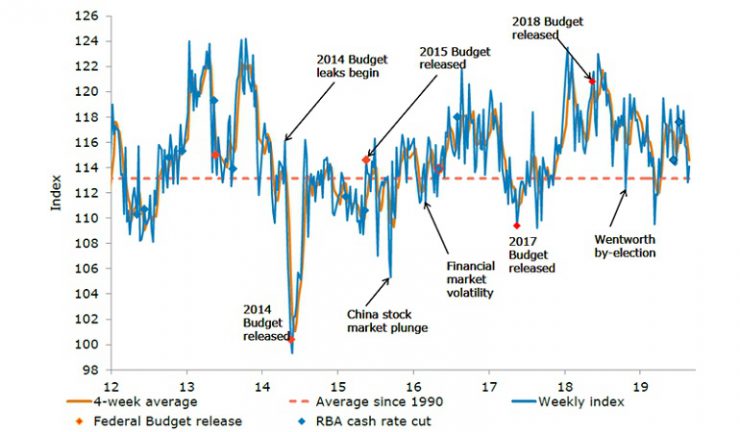

Consumer sentiment gained 1.2%, pushing the index above its long-term average. The time to buy a major household item sub-index rose a healthy 4%, after falling for three consecutive weeks.

“This week’s gain in consumer confidence is pleasing, considering the news flow around the US-China trade war and the resulting equity weakness,” ANZ head of Australian economics, David Plank, said, with lower interest rates and taxes also helping to boost confidence.

Sentiment toward current finances has gained for three consecutive weeks, rising to its highest level since weekly surveys began in 2008. “This has been sufficient to push overall confidence back above its long-run average. We think the divergence between financial and economic sentiment can be sustained, so long as the labour market remains solid. Also of note is the lift in inflation expectations for the week, to back above 4%,” Plank said.

Economic conditions however were mixed with current economic prospects falling 1.4%, the fourth consecutive decline, while future economic conditions had a marginal gain of 0.2%. Both indices are below average.