On top of weak growth figures.

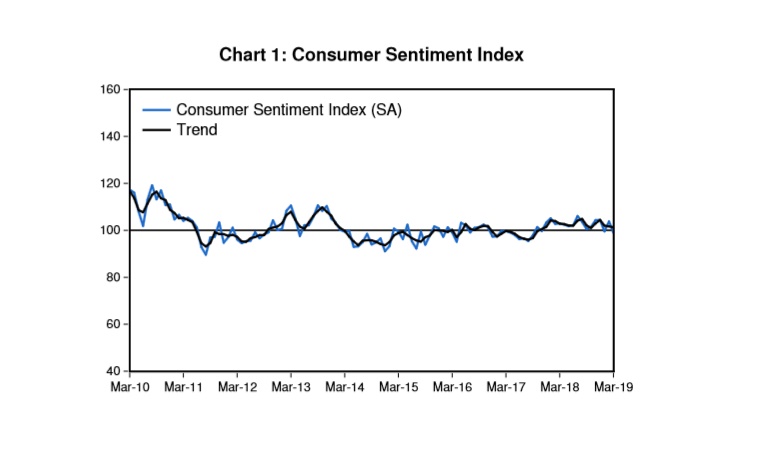

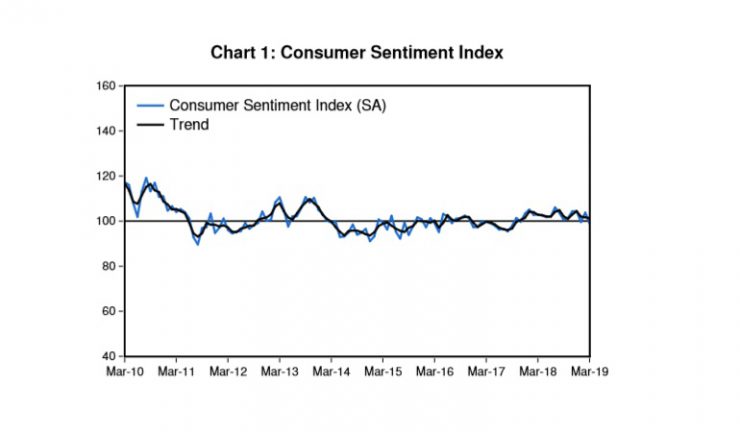

Consumer confidence has fallen to its lowest level in 18 months as the economy continues to move in slow motion. The Westpac-Melbourne Institute Index of Consumer Sentiment fell 4.8% in March, and pessimists now outnumber optimists.

Consumer confidence also took a hit with NZ-Roy Morgan data falling 4.6% from the previous week’s reading. All the sub-indices were in the negative, with three components falling more than 5%.

Westpac senior economist, Matthew Hassan, said the December quarter national accounts update that showed Australia’s economic growth slowing to a 1% annual pace over the second half of 2018, was widely described as a ‘per capita recession’ in media coverage. The survey detail indicates this had a significant negative impact on confidence.

“Responses to additional questions on news recall also suggest the economic news had a major bearing on consumers,” he said. “Australia’s housing market downturn, a key factor in the disappointing December quarter growth figures, also looks to have had a more direct impact on sentiment. Consumers in Sydney, which has seen the largest house price declines over the last 18 months, recorded a sharp 10% fall in sentiment.”

With the December quarter national accounts likely clarifying what were previously somewhat mixed signals about the extent of Australia’s growth slowdown, the March weakening in consumer expectations for the economy looks likely to be sustained, Hassan said.

ANZ head of Australian economics, David Plank said the soft GDP report and also focus on the “per capita recession” were the primary factors in the plunge. Economic conditions sub-indices were in the negative, with current economic conditions falling a sharp 7.9% and future economic conditions declining 5.4%. Current financial conditions fell 2.9%, while future financial conditions took a bigger hit, falling 5.4%. The ‘time to buy a household item’ also fell 1.7% vis-à-vis a decline of 2.1% in the previous reading.

“The last such big decline in confidence was the weekend of the Wentworth by-election, something we thought was unlikely to have a lasting impact on sentiment,” Plank said. “This decline could be longer-lasting as it appears to be more related to underlying economic conditions. If it proves to be a sustained decline then it is yet more bad news about a household sector that is already under pressure. No doubt the RBA will take note.”

While Westpac expects the RBA to cut the cash rate by 50bps by the end of 2019 it does not expect the bank to move rates at its April 2 meeting. The weak December quarter national accounts will prompt a further downward revision to the banks growth forecasts, Hassan said, however, this is unlikely to shift its views on the labour market – an area of strength the RBA has highlighted as key to its policy considerations – by enough to warrant a policy easing.

“We expect the first 25bp rate cut from the RBA to come in August once the extent of spillovers from the housing downturn on the labour market in particular becomes more apparent, with a follow-up 25bp cut in November,” he said.