Facing headwinds in 2019.

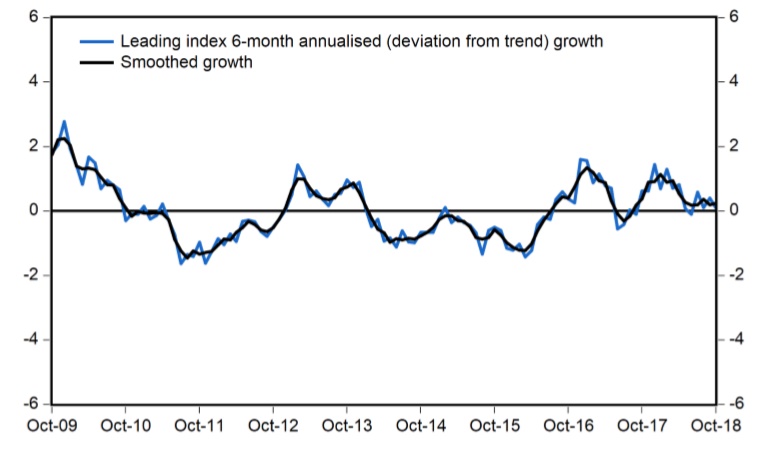

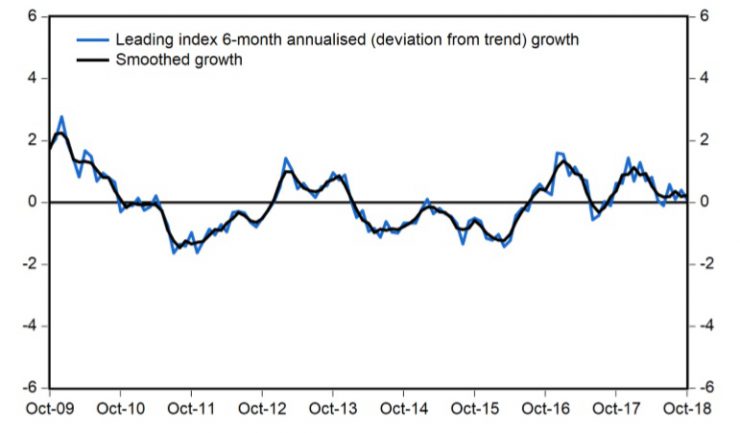

The six month annualised growth rate in the Westpac–Melbourne Institute Leading Index, which indicates the likely pace of economic activity relative to trend three to nine months into the future, fell from 0.41% in September to +0.08% in October.

With this latest slowdown, the index growth rate continues to point to slowing momentum into the New Year,” Westpac chief economist, Bill Evans said. “Over the seven months from October last year to April this year the growth rate averaged 0.89%. In the six months since April the growth rate has averaged only 0.19%, a clear step down.”

He said the readings to April were consistent with the strong, above trend momentum in the official growth figures that showed the Australian economy growing at a 4% annualised pace in the first half of 2018. However the weaker reads seen in recent months point to a slower growth pace over the second half of 2018 and into 2019. Westpac also expects momentum to slow to around 2.5% in the second half of 2018, which will be slightly below trend, with this slower pace to be sustained through 2019 at around 2.7%.

“Factors that we anticipate will be important headwinds for growth going forward are, an uncertain outlook for the consumer with ongoing weak wages growth, falling property prices in Sydney and Melbourne and a very low savings rate pointing to limited capacity for households to maintain current spending momentum. We also expect a slowdown in jobs growth as both political uncertainty and global volatility weigh on firms’ employment decisions through the first half of 2019,” Evans said.

Despite a generally upbeat set of minutes from the Reserve Bank’s November Board meeting, these noted that “the outlook for consumption continued to be a source of uncertainty in an environment of slow growth in household incomes, high debt levels and easing conditions in housing markets in some parts of the country.”