Records a slight rise.

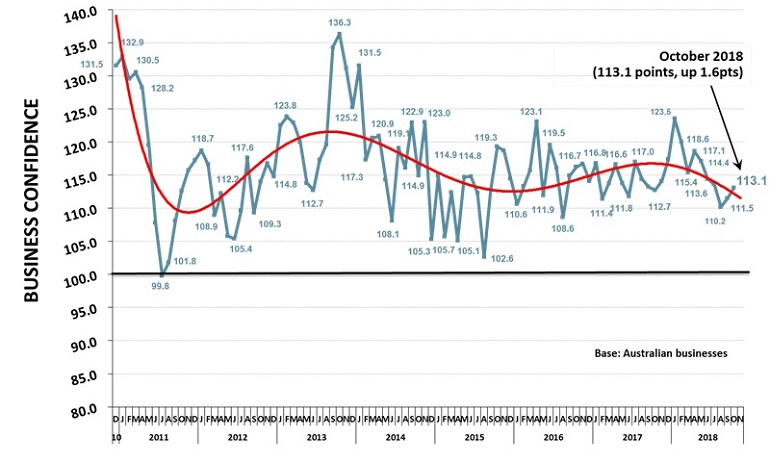

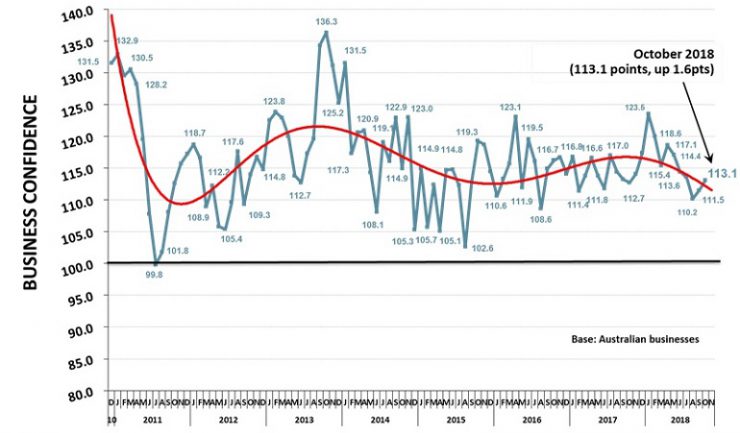

Business confidence rose 1.4% in October, continuing a rebound which began following the Liberal leadership instability in late August, and is almost back to the July level, prior to the leadership challenge.

According to Roy Morgan data, business confidence is now 0.4pts above its level of a year ago and 3.1pts below its long-term average of 116.2. However, despite recent softness, business confidence so far during 2018 has averaged 115.7, the highest yearly average since 2014.

Businesses were largely positive in October with a majority expecting ‘good times’ for the Australian economy over the next 12 months.

Roy Morgan CEO, Michele Levine said business confidence has continued recovering from the political turmoil in late August although uncertainty over the government’s stability after the loss at the Wentworth by-election in late October could weigh on confidence.

“Analysing trends in business confidence by size of business based on annual turnover shows that it is micro businesses, with annual turnovers of less than $1 million that have boosted business confidence over the last year,” she said. In contrast, businesses with an annual turnover of $1 million to $5 million and businesses with annual turnover of $5 million or more have experienced small declines since October 2017. “Clearly business confidence for these larger businesses remains significantly higher than for micro businesses but the gap has closed.”

Looking at individual industries, business confidence for rental, hiring, real estate, construction, wholesale and retail trade is lower than a year ago. However, it has improved across information media and telecommunications, public administration, safety and security, professional, scientific and technical services and manufacturing sectors.

According to Levine, the slowdown in residential real estate is clearly weighing on real estate and construction while the intense media focus on the Finance Royal Commission (FRC) is providing a constant flow of poor headlines for some of Australia’s largest companies including the big banks as well as finance and insurance companies like AMP.

“The scope of the FRC to dig deeply into the conduct of these large businesses is providing a clear warning to other larger businesses in Australia that if the public and political focus turns in their direction their conduct could also face intense scrutiny. This chilling effect on bigger businesses, combined with the policy uncertainty as we face a Federal Election early next year, are powerful drivers that explain why business confidence for larger businesses in Australia is down from a year ago,” Levine said.

Analysis state-by-state shows increases in New South Wales, Queensland, Tasmania and South Australia which again has the highest business confidence of any state. “The good news for the relatively new government in South Australia is that it has consistently been the highest in Australia for over a year now. However, the overall monthly trend business confidence fell in Victoria and Western Australia with WA once again recorded the lowest in business confidence of any state.”