For consumer sentiment.

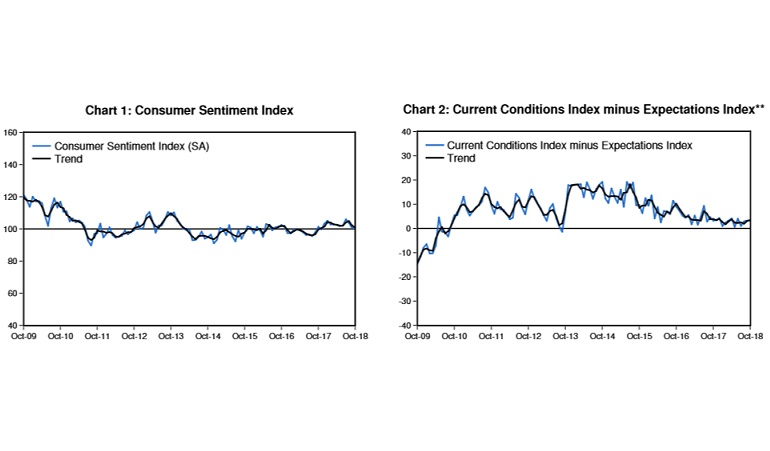

The Westpac Melbourne Institute Index of Consumer Sentiment rose 1% in October, a small gain following a 5.2% fall through August and September.

Westpac chief economist, Bill Evans said the boost from tax cuts announced in the May budget had faded while the leadership change, mortgage rate increases, declining house prices and rising petrol prices were weighing on confidence.

“It is encouraging that these negatives seem to have, at least for the time being, run their course. Several positives have likely helped stabilise the index, including strong economic growth, a solid labour market and ongoing recoveries in previously weak mining states.

“The net effect has seen the headline index holding slightly above the 100 line indicating that optimists are just outnumbering pessimists,” Evans said. However, concerns around interest rates and house prices were still apparent with sentiment amongst households with a mortgage weakening in October, dipping a further 0.8% to be down 6.4% over the last two months.

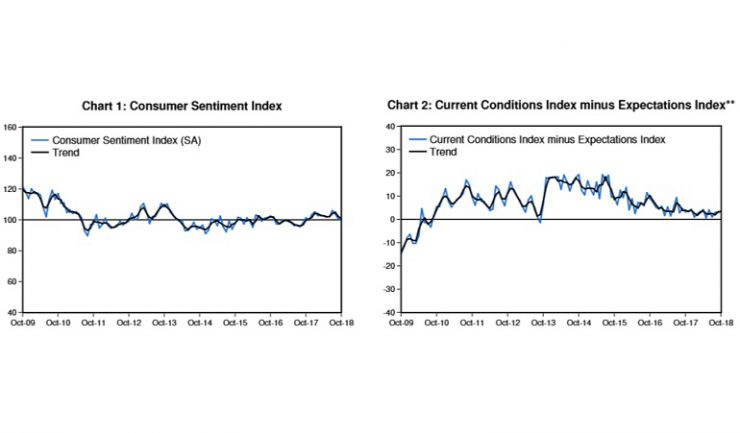

Spending-related sentiment showed little change on the relatively downbeat tone in recent months with the ‘time to buy a major household item’ sub-index inching 0.1% higher but still hovering around the lowest levels seen since last November. And consumer views around housing continue to deteriorate, with the ‘time to buy a dwelling’ index slipping a further 0.9% following September’s 4.8% fall, unwinding all of the 5.5% gain in August.

Consumer expectations for the economy also showed mixed moves. The ‘economic outlook, next 12 months’ sub-index posted a solid 2.3% rally but longer term expectations continued to soften. The ‘economic outlook next five years’ sub-index is now down 9.1% from the five year high recorded back in July.

Consumer expectations for house prices posted another sharp fall in October, dropping 7.4%, taking the index below its 2015 low point to the weakest level since the first month the survey question was run in May 2009. The state detail showed a particularly sharp 20.3% drop in Victoria, suggesting the price correction in Melbourne, which has been slower to come through than in Sydney, is starting to bite, Evans said.

“House price expectations are now particularly weak in NSW and Victoria although in both cases state indexes are still above the prints seen in Western Australia when the Perth market was moving into its prolonged price correction in 2015-16. In contrast, price expectations remain bullish in Tasmania and are holding at positive levels in Queensland,” he said.