Wearables the watchword.

Australians are taking to wearable devices as smartphone sales weaken, according to new research from technology firm, Telsyte.

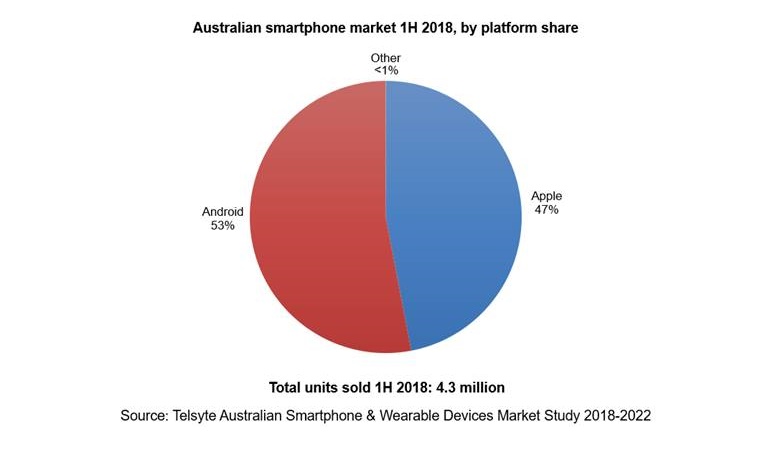

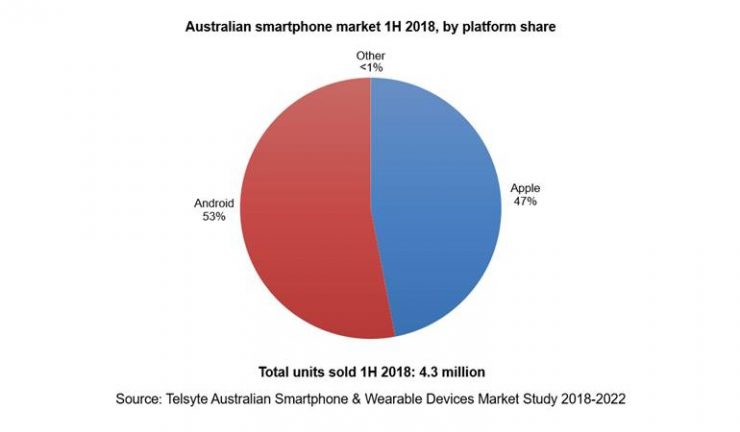

The Telsyte Australian Smartphone & Wearable Devices Market Study 2018-2022 found 4.3 million smartphones were sold in the first half of 2018, a fall of 3.7% from 4.4 million from the same time last year. And one in three smartphone owners are showing signs of holding off buying a new smartphone until 5G models become available, possibly impacting market performance in the next 18 months before 5G smartphones become widely available.

However, smartwatch sales are growing with around 680,000 units sold during the first half of 2018, up by more than 80% from the first half of 2017 with Telsyte estimating that around 15% of smartphone users now use a smartwatch.

Apple continued to dominate the smartwatch market, with more than half of all units sold an Apple Watch. Others, including Fitbit, Samsung and Garmin are starting to see growth due to greater awareness, lower prices and customers upgrading from basic fitness bands. Apple Watch also has the highest repeat purchase intention at 80%, while Fitbit sits at around 60%.Smart accessories like Apple AirPods have been a key companion to the iPhone with Telsyte estimating more than 800,000 have been sold in Australia since launching at the end of 2016.

Other potential wearable categories, such as smart glasses are also gaining interest, with Telsyte research showing one-in-five consumers are showing signs of buying one, especially if the design is slim and light, similar to sunglasses, and priced similarly to a smartphone or tablet.

It was a sobering first half of 2018 for Android smartphone sales after a strong upgrade year in 2017, Telsyte senior analyst, Alvin Lee said. “The balance of 2018 could remain in favour of Apple with more iPhone users expected to be coming out of contract this year,” he said.

Android sales during the measured period were down 7% while Apple was up 2% although Android was still leading in market share with 53% versus Apple on 47%.

Apple remained market leader in the first half, with Samsung, Oppo and Huawei making up the top four. And Australians are gravitating towards premium models with more than 55%, of iPhones purchased in the first half higher end models, including iPhone 8, 8 Plus and X, compared to 50% a year ago (iPhone 7 & 7 Plus). And 32% of smartphones purchased outright cost more than $800 in the first half of 2018 compared to only 22% in 2016.

Apple maintained the highest repeat purchase intention on 90%+, followed by Samsung on 85%+. No other smartphone brand has a repeat purchase intention rate of higher than 55% in Australia.

Things could look up however with the arrival of 5G expected to create the next big upgrade event, according to Telsyte managing director, Foad Fadaghi. “Carriers will be hoping 5G smartphones are available ahead of their network launches, if not soon thereafter,” he said.

Telsyte found that of those most willing to wait for 5G handsets includes users of premium model smartphones, (e.g. Samsung Galaxy S8 & S9, iPhone X, iPhone 8) at around 50%, and those currently on contract, (40%). Nearly half of iPhone users intending to purchase a new iPhone in 2019 indicated they were likely to wait until a 5G iPhone was available.