Hitting 1.44 billion units.

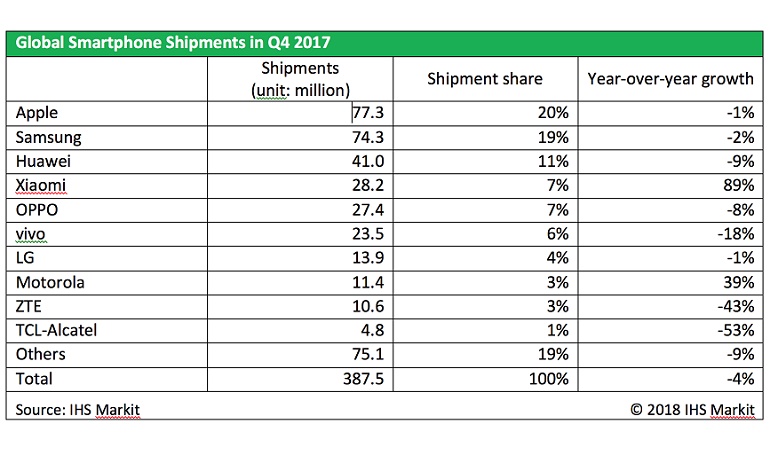

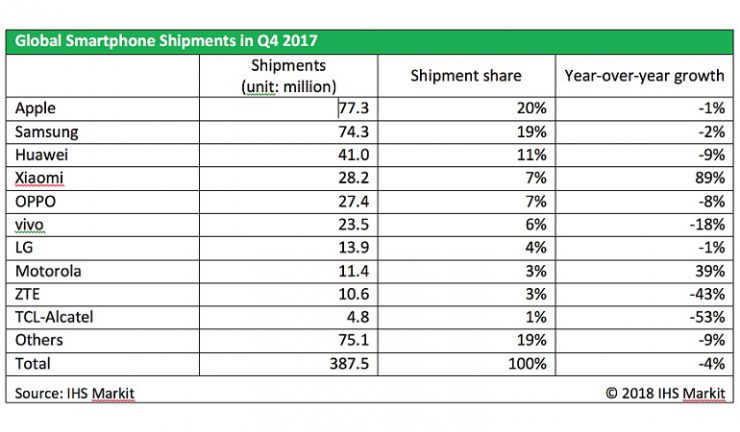

Global smartphone shipments grew 3.1% in 2017 reaching 1.44 billion units but declined 4.5% in Q4 2017, according to preliminary data from IHS Markit. Of the leading handset brands, only Xiaomi and Motorola experienced shipment growth in Q4.

Apple led the market in Q4 shipping 77.3 million units, which was 1.2% lower than the previous year. Sitting on second place was Samsung with shipments falling 2.2 %, to reach 74.3 million units. Apple shipped 20% of all smartphones in Q4, followed by Samsung at 19%, down from 23% in the previous quarter.

Apple’s iPhone X gained traction as soon as it became available to customers in November. New devices clearly helped Apple push its average selling price (ASP) to $796, which is $101 higher than the previous year. Even though the company sold fewer handsets in 2017, it was able to generate more revenue through new and higher-priced models.

Despite its shipment decline Samsung improved its product mix in the middle and high-end ranges. However, Samsung had to spend more in marketing to sell its devices, which affected profits for its IT and mobile communications division. The turn toward more value-added handsets helped Samsung avoid direct competition with Chinese players in low-end price segments, which often come with lower or negative profit margins.

According to IHS Markit, Samsung is expected to unveil its S9 Galaxy S flagship model in February 2018, with sales starting in March. This timing is earlier than the S8, which launched in late March last year, with sales starting in April. The availability of a new flagship model in the first quarter should boost Samsung’s product mix and ASP.

Behind market leaders Apple and Samsung, Xiaomi continues its strong growth curve, which began in Q2 2017. Its performance raised its share of global smartphone unit shipments, from 4% in 2016 to 7% in 2017.

As it did in Q3, Huawei followed Apple and Samsung with shipments declining 8.6%, the first time its smartphone shipments have contracted on a year-over-year basis. The company’s international ambitions hit a roadblock in the US, as government opposition is closing the path to carrier partnerships for its flagship devices. Huawei shipped fewer than 200,000 units to the US in Q4, in a market dominated by Apple and Samsung.

LG Electronics shipments declined slightly by 1.4% falling to 13.9 million units. Compared to other global manufacturers, LGE defended well against competitors, as sales of mid-tier segments increased. Still, the company is struggling to gain traction in high-end devices, since its competitors benefit from larger marketing budgets. The continued losses of its LGE Mobile Communications business unit forced the company to change how it will release new handsets in the future, focusing more on optimising returns for each model, instead of maintaining the usual annual upgrade cycles.

A bright point for Lenovo was its Motorola line of smartphones rising 39.5% in Q4.

Many smartphone brands will experience changes in 2018. Google and HTC just completed their deal to transfer personnel and IP from HTC to Google and LGE’s smartphone business will continue to drag down the company’s overall performance while other brands face hard decisions over the next few quarters, according to IHS Markit.