Modest Christmas outlook.

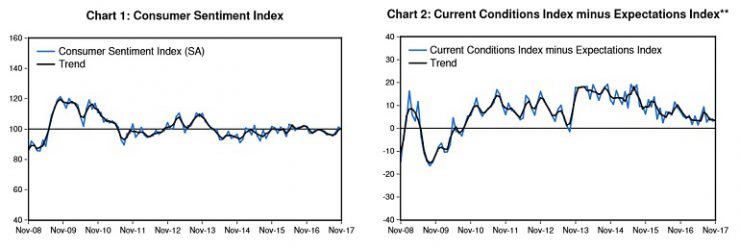

The Westpac Melbourne Institute Index of Consumer Sentiment declined 1.7% to 99.7 in November from 101.4 in October with Westpac chief economist, Bill Evans, commenting that last month’s return to slight optimism has proven to be short-lived. “While the index is still up 4.4% from its August low, the November decline takes it back below 100.”

And the November survey offered a critical read in the lead-up to Christmas. “Aside from the downbeat headline, responses to our annual question on Christmas spending plans also point to moderate activity. Just under one-third of Australians expect to spend less on gifts this year, with 54% expected to spend about the same and just 11% spending more, the lowest proportion since we began running this question in 2009,” he said. “ The net balance of ‘more minus less’ is marginally more negative than last year, suggesting we’re in for a repeat of last year’s lacklustre Christmas spend. The state responses show consumers in Victoria and NSW are a little less inclined to restrain spending while those in SA and WA are tilting more towards cutbacks.”

Overall, the consumer mood has been downbeat in 2017 with clear pressures on family finances and an uncertain economic outlook weighing on sentiment. Constant media coverage around the prospect of rising interest rates may also be unnerving households, Evans said. “The confidence of respondents holding a mortgage fell by 4.5% compared to a more modest fall of 1.4% for mortgage free owners and a 0.5% increase for tenants.”

Economic uncertainty again featured in November, likely affected by the ‘citizenship saga’ impacting Federal Parliament. The economic conditions next 12 months sub-index fell 6.2%, unwinding most of last month’s strong rise while the economic outlook for the next five years sub-index declined 2.2%.

The time to buy a major household item sub-index fell 3.3%, retracing almost all of last month’s gain and remains well below its long run average, suggesting that the sluggish spending evident through most of 2017 is likely to extend to the end of the year.

“The ‘time to buy a dwelling’ index rose 3.4% to 98.3, a nine month high but still well below the long run average of 120. The sub-group detail showed improved readings in NSW, from a very weak starting point, in Queensland and amongst first home buyers. This was partially offset by deterioration in buyer sentiment in Victoria and across older age groups,” he said. “With house prices easing in the Sydney market but still increasing in Melbourne this contrast between Sydney and Melbourne may be reflecting improved relative affordability.

“The Reserve Bank released its latest Monetary Policy statement on November 10 with some significant changes in forecasts, particularly for underlying inflation in 2018 to 1.75%, below the bottom of the 2–3% target zone. This compares with the forecast in the August Statement of 1.5–2.5%, a mid-point at the bottom of the target zone.

The bank is now forecasting underlying inflation at 2% in 2019 – down from 2–3% in August. The bank continues to forecast growth of 3.25% in 2018 – 0.5% above potential growth of 2.75% although it has lowered its forecast for growth in 2019 from 3–4% to 3.25%, Evans said. “Our interpretation of these forecast changes is that in August the bank expected to be raising rates some time in 2018 and that prospect is now much less clear. In fact, if their lower inflation forecasts prove correct the bank is unlikely to move in 2018. We are maintaining our long held view that rates will remain on hold through 2018.”