According to Roy Morgan.

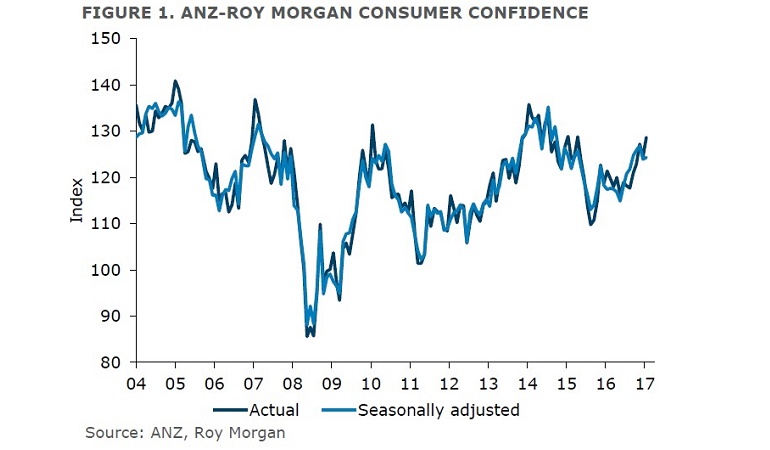

Consumer confidence for the week ending November 5, 2017 slipped 0.7% to 112.6 points in the latest ANZ-Roy Morgan Index, a touch under its long-term average of 112.9. The details were broadly negative, with four out of five sub-indexes showing falls.

The ‘time to buy a major household item’ index slipped 0.5% to 132.1 and remains below its long term average of 133.8.

There was some good news, with the outlook on economic conditions in the next year rising 2.1%, partially offsetting a 4.5% fall in the previous week. However, consumers were more pessimistic about longer-term future economic conditions with the sub-index slipping 2.8% last week, its lowest value in eight weeks.

Consumers views about current financial conditions also eased by 0.5%, after a solid 5.3% jump the previous week. The outlook for future financial conditions fell for the third straight week bringing the index down to its lowest point in 11 weeks. The weekly value for inflation expectations fell to 4.3% last week after remaining stable at 4.5% for the previous four weeks.

ANZ head of Australian Economics, David Plank, commented that it was encouraging to see that households’ views towards their current finances remain above the long term average. “This suggests that they have been able to weather the pressure on their wallets caused by the jump in energy prices, although not without some hit to retail sales. Given limited wage gains, slowing house-price growth and an already low savings rate, consumers are increasingly less certain about the future, as reflected in the recent downtrend in future conditions. A similar story holds true for the economic conditions sub-indices,” Plank said.

“Broadly, consumer confidence continues to track around its long term average supported by still accommodative monetary conditions and a strong labour market with next week’s employment and wage price index release likely to influence confidence in the coming weeks.”