Consumer sentiment still in the doldrums.

Despite the Westpac Melbourne Institute Index of Consumer Sentiment rising 2.5% to 97.9 in September from 95.5 in August, consumer sentiment stayed weak. “Consumer mood remains downbeat with September marking the tenth consecutive month that pessimists have outnumbered optimists,” Westpac’s chief economist, Bill Evans said. Pressures on family finances, concerns around interest rates, deteriorating housing affordability and rising energy prices have all weighed on confidence in 2017, Evans said. “These factors have more than offset the boost from an improved outlook for jobs particularly when a stronger labour market has not been associated with increased wages growth,” he said.

The survey indicated family finances remain a key area of concern, however consumer expectations for the economy showed more consistent gains. Evans said the improved but still lukewarm sentiment towards the economy reflects a mixed picture from recent data, including June quarter national accounts which showed a reasonably solid 0.8% gain in GDP along with subdued annual growth and notable areas of weakness around household incomes and consumer spending.

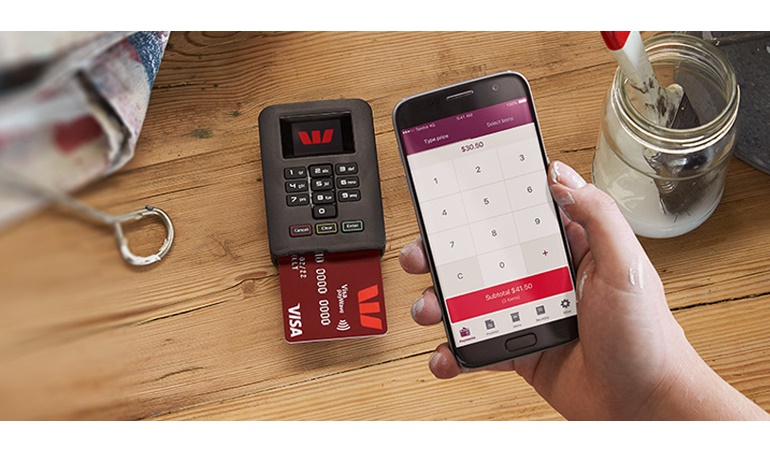

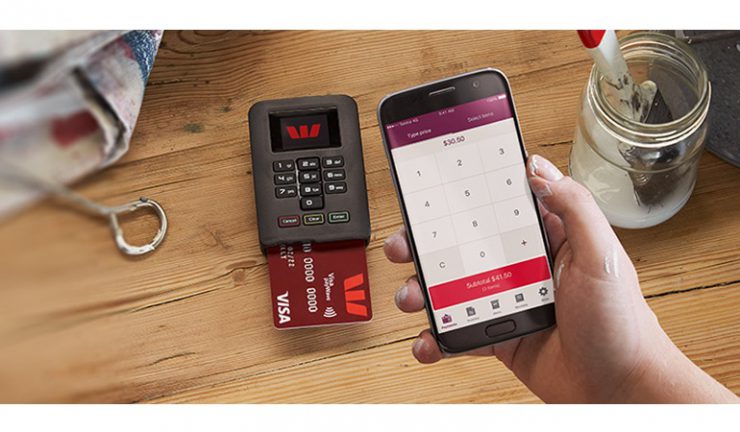

“Consumers were slightly more positive towards major purchases with the ‘time to buy major a household item’ sub-index rising 2.1% in September. However, the rise was small and, coming off a weak August read, the sub-index remains well below its long run average,” Evans said.

The September survey also included additional questions on news recall that provides further insight into the factors shaping sentiment. Interestingly, recall levels have fallen significantly over the last three years suggesting consumers may be getting less exposure to news in general. In September the topic areas with the highest recall were ‘economic conditions’ (21%); ‘budget and taxation’ (17%); interest rates (16%); inflation (16%); jobs (15%); and international conditions (12%). While news on all fronts was viewed as unfavourable, consumers rated news on inflation and international conditions as much more negative than three months ago, possibly reflecting sharp increases in energy costs and developments around North Korea. The only material improvement was around jobs where news was viewed much less negatively than in June.

According to Evans of more interest is the medium term outlook for interest rates. “While those commentators favouring rate hikes next year point to record business conditions we are starting to see a considerable gap open up between business conditions and business confidence,” he said. “Persistent weak consumer sentiment, consistent with weak consumer demand, may be worrying businesses around the sustainability of current strong conditions. From our perspective prospects for consumer spending and residential construction appear soft. We do not expect that economic conditions in Australia in 2018 will be consistent with the need for the Reserve Bank to raise rates.”