Consumers spend reluctantly.

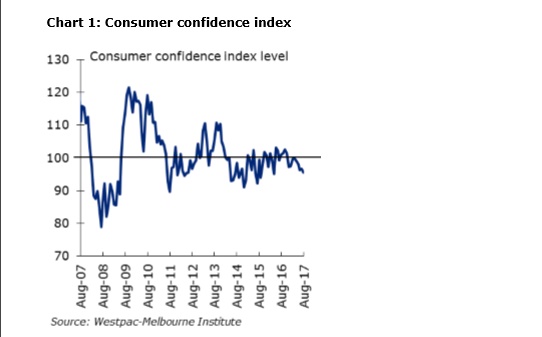

Consumer sentiment might be drifting downwards, but retail spending growth has picked up, according to Deloitte Access Economics’ latest Retail Forecasts report.

“Strengthening employment outcomes are providing the basis for spending to lift, including a rebound in full time jobs growth and continued wealth gains from housing,” Deloitte Access Economics partner, David Rumben said.

But despite improvements in unemployment expectations and an increase in business confidence, consumer sentiment is at a low point with concerns over financial risks. “In the face of oncoming competition from the likes of Amazon, with widespread aggressive discounting to lure in the consumer dollar and rising energy prices, it’s likely retailers aren’t so happy either,” Rumben said.

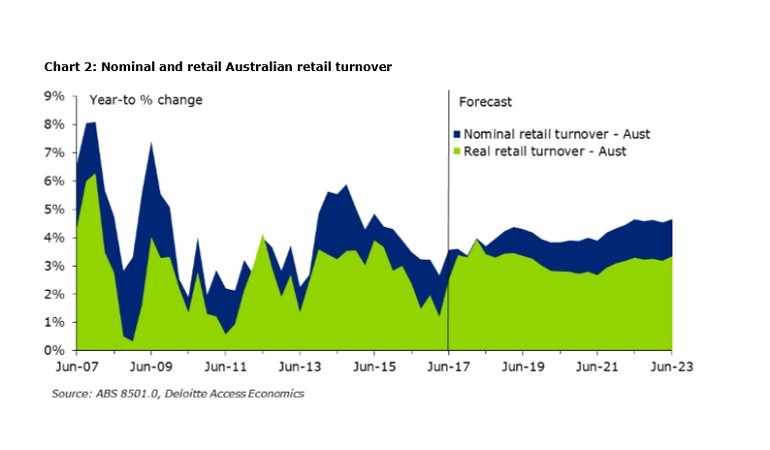

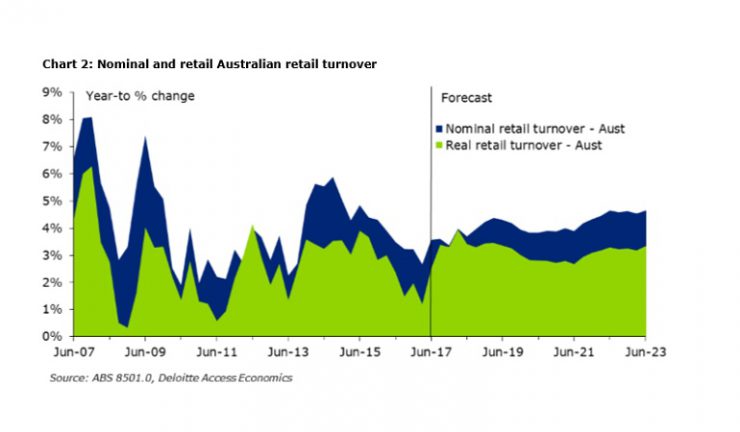

There was an unexpected move upwards in spending for the June quarter with real retail turnover rising 1.5%, the highest real growth result since the March quarter in 2013, and follows a subdued start to 2017 for retail spending growth. This signals an improved spending outlook after three months of negative turnover growth in the last year.

However while retail volumes have improved prices are struggling. Retail price growth is minimal, at 1.0% over the year to June 2017 with intense competition keeping retailers focused on delivering customer value at the least cost possible. Rumbens believes the entry of Amazon and other international online retailers into the market over the coming years will put further downward pressure on prices.

According to the report, nominal retail spending growth for the year to June 2017 was 3.6% and is expected to remain steady at that rate over the year to June 2018. “However, more of the growth next year may come from volume growth, with prices increasingly under pressure. Retail volume growth for the year to June 2017 was 2.5%, rising to 3.4% for the year to June 2018,” he said.

Household goods are back on top, outpacing all other non-food retail categories in the year to June 2017, with 5.8% real turnover growth. On the other side of the spectrum, real turnover growth for department stores remained weak over the past year at 1.3%.

Jobs growth has also swung back with full time jobs rising 1.9% between December 2016 and July 2017, while part-time jobs grew by just 1.3%. This is a substantial turnaround when compared with 2016, when the absolute number of full-time jobs declined. “However, at around a third of total employment, the proportion of part-time jobs is still high and this is associated with significant underemployment that sits on 9.3%, which means almost one-tenth of workers would prefer more hours of work than they currently have.”

Energy and electricity prices are also putting pressure on retail margins with the average price of electricity in Australia increasing by 116.4% over the last decade, and 7.8% over the past year. “On the bright side, retail wage growth is growing even slower than the record low average wage growth across the economy,” Rumbens said.