(For clarity, Topfield is a South Korean manufacturer of personal video recorders and associated products. Toppro is an Australian company that has held a licence to wholesale the brand to agents and retailers in the local market.)

Topfield expects to restart supplying personal video recorders and set-top boxes to its distribution agencies and retailers within “a week to 10 days”. This announcement was made by national sales and marketing manager Orlando Nascimento, who is transferring across from former licensee Toppro to the new sales and marketing company established by the Korean manufacturer.

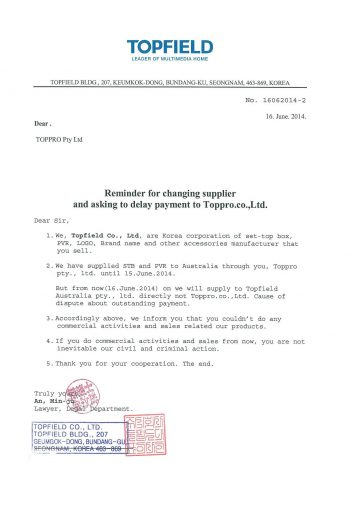

The disruption to supply was caused by a dispute over money between the Seongnam, South Korea-based specialised in PVRs and STBs and the local distributor. The issue came to a head on 16 June 2014, when Topfield sent letters to Toppro’s agency and retail customers (printed below), telling them to cease dealing with Toppro and that Topfield would soon be setting up its own Australian operation.

Appliance Retailer understands that over the intervening period, representatives of Topfield have flown to Australia to attend arbitration meetings with Toppro management, and that as a result, the distribution licence has been handed back to the Korean company. Senior staff, including Toppro shareholder Alan Kwon, have now left the organisation.

Nascimento said that the new Topfield is committed to honouring any outstanding amounts owed by Toppro to agents and retailers, as well as warranties currently held by customers of the former wholesaler.

“The idea is to resume the supply lines as soon as possible, using the existing channels,” he said. “We will set up a permanent entity as Topfield Australia.

Until such time as the standalone subsidiary can be properly established as a legal entity, the Topfield has essentially assumed control of Toppro, Nascimento reports.

“Korea wants to get it back to business as usual ASAP and obviously they will inherit any of the debts owed by Toppro because, in effect, Toppro is now directly under the control of Topfield Korea.

“We are looking to re-establish supply as soon as possible. At the moment, we are in the initial stages of updating our major channels and the idea from Topfield Korea is to use the current set up to resume soon, hopefully withing a week to 10 days.”

Nascimento confirmed that the new operation is still committed to using sales agents to represent the brand in areas where it is not feasible for the new subsidiary to have direct representation. “That is my decision and I am committed to that,” he said. “We’ll still be using the exact same set up that we had when Toppro was the distributor.”

Because Topfield products were being distributed by a third party, Nascimento said that there were “short falls” in how the various products were being taken to market. He said that as the national sales and marketing manager under the new subsidiary model, he will have greater power and resources to cover these short falls.

“As a distributor, we had limits as to what we could spend on marketing; now I have the backing of the parent company directly. When you are a distributor and an entity outside away from the parent company, you are obviously much more limited in resources and funds, because it was being run as a private business.”

In addition to an increase in marketing, the trade should expect Topfield to bring new products into the market and enjoy greater after sales service.

“Going forward, retailers should expect to see a greater presence of the Topfield brand in the market,” he said. “They will also see much greater support on the back-end, as far as the supply chain in concerned. We want to participate with retailers in sales events and marketing campaigns.”

The main downside for retailers with this move, Nascimento concedes, is this temporary supply gap.

“As of the beginning of last week, Topfield did put a stop on supply, but last week both sides sat down in front of a barrister and it was decided that, based on contractual agreements that were established during the set-up of Toppro and present conditions, that the local shareholder would have to relinquish his share of the company.”

One of the advantages for the new Topfield operation in Australia will be greater flexibility in terms of the product made available to the Australian market. Toppro formerly had the final say on which products would be made available locally whereas now there is more scope to introduce a broader range. “All of a sudden, the Korean parent company has somebody over here directly overseeing the market situation in Australia,” Nascimento said.

Topfield has traditionally claimed a sizable chunk of the $27 million PVR market in Australia, in which competes with Beyonwiz, Strong and Humax, amongst others. This doesn’t include the hybrid PVR and DVD or Blu-ray market, which is a $35 million market and has traditionally been dominated by Panasonic.

Appliance Retailer has attempted to contacted former Toppro representatives for comment.