As sector sheds jobs.

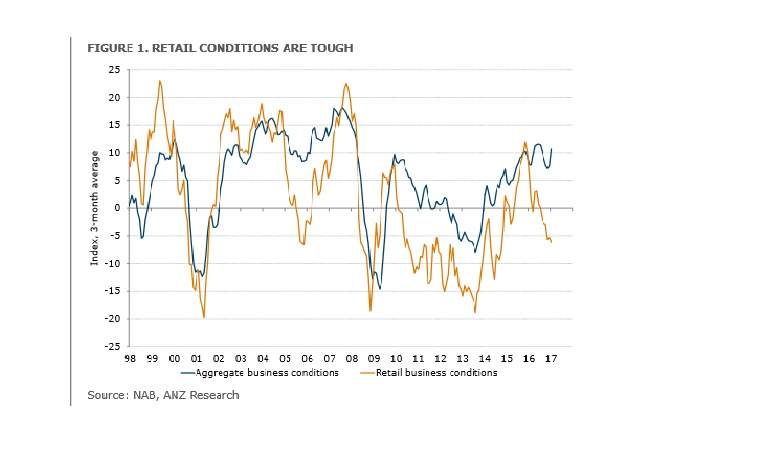

No surprises from the latest ANZ Australia Insight into Australia’s retail landscape. It showed conditions in the sector are difficult and likely to remain so given intense competitive pressure around pricing and slowing growth in retail sales per capita. The surge in foreign retailers opening brick and mortar stores continues to disrupt the retail landscape and along with the rumoured opening of Amazon this year, pricing pressures are expected to remain intense for at least the next year or two.

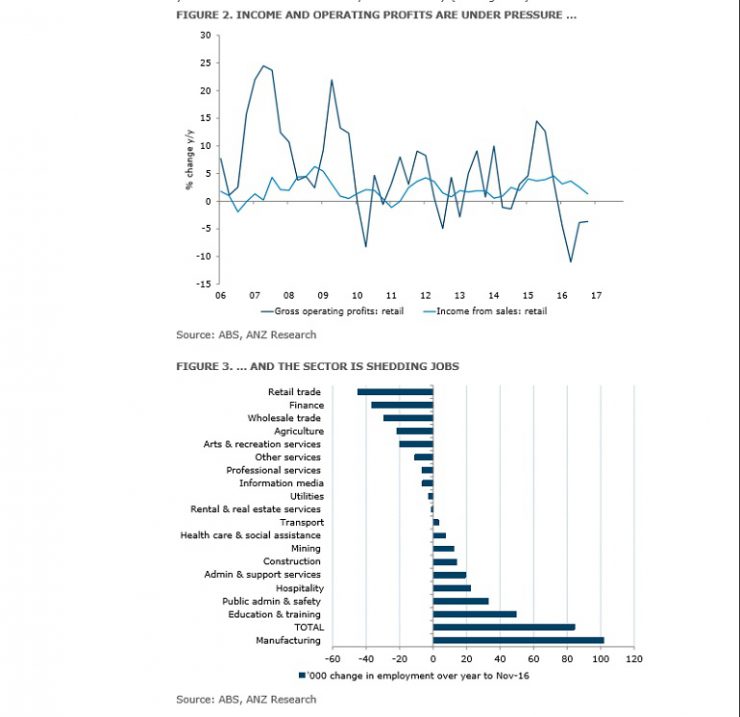

While consumers will benefit from lower prices, ongoing weak retail price inflation will weigh on the broader inflation profile, leaving an up-lift in wage growth as critical to underpinning a rise in core inflation. Softening demand is said to be part of the explanation with annual growth per capital slowing in both retail sales and retail spending. Retail sales volumes were up just 2% in the year to December 2016, well below the long run average of 3.6%.

In part this reflects shifting consumption patterns away from traditional retail goods in favour of services. In contrast to relatively weak retail sales, overall private consumption has been rising steadily, by around 2.5% annually, for several years now. The retail sector has also been shedding jobs, with more jobs lost in the year to November 2016 which is more than any other industry.

The Global Powers of Retailing 2017 report by Deloitte found 41% of Australian retailers cited foreign-owned brick and mortar stores as their greatest competition and 12% reported that pricing is a key focus this year, up from just 2% in 2015. Foreign retailers are attracted by relatively high margins in Australia and will continue to enter the market as long as that additional margin is on offer. While it’s difficult to put timing around this, it would appear to have further to run across all industries. In its most recent Statement of Monetary Policy (SoMP), the Reserve Bank of Australia noted: “the disinflationary effects on final retail prices from heightened retail competition and low wage pressures are expected to dissipate slowly, although there is uncertainty about the size and timing of these effects”.

Of course the ‘x’ factor in all of this is Amazon, which has reportedly lodged over 250 trademarks and advertised for over 100 roles in IT, marketing, sales and human resources. And as the Deloitte report concludes “What we do know is that where Amazon has entered new markets the impact on local retailers has been seismic and has impacted almost all categories and channels”.

Both demand and pricing power are likely to see retail conditions remain difficult this year and next. To date, rising house prices, strong employment growth, and a fall in the household savings rate have helped to offset weak household income growth and support consumption at around trend growth rates. Looking forward, however, wage growth is expected to remain weak, the decline in the unemployment rate to continue but at a more gradual pace, and house price growth to moderate. In this environment, and given already elevated levels of household debt, it is doubted that households would be willing to rundown savings much further.