Optimists and pessimists in equal numbers.

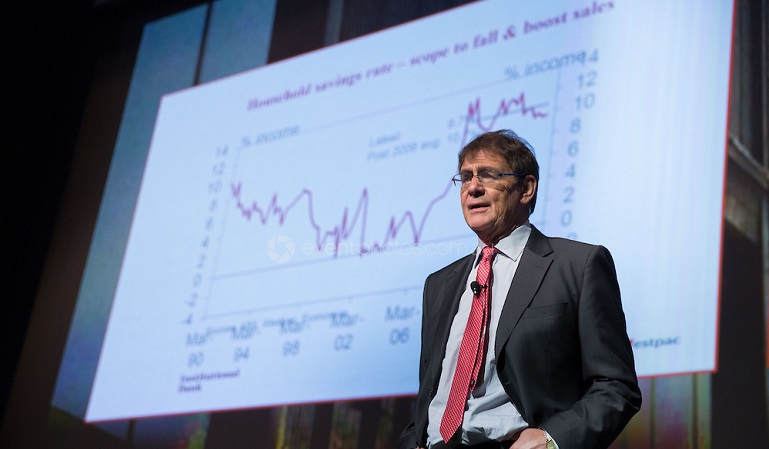

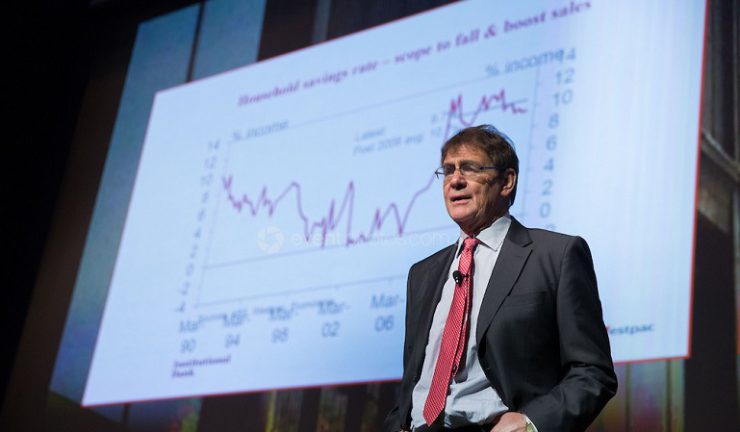

The Westpac Melbourne Institute Consumer Sentiment Index rose 0.1% in March, stabilising to the point where optimists and pessimists are around equal in number, Westpac chief economist, Bill Evans said. “The encouraging 2.3% lift we saw in the index in February was sustained in March.”

To gauge an assessment of what might be on their minds survey respondents were asked for information on news items that have affected their views and whether this had been well received.

“As we saw in December the two dominant news categories were ‘economic conditions’ (27.9% of respondents recalled news on this topic) and ‘budget and taxation’ (25.2%). On both counts respondents saw the news as less unfavourable than had been the case in December and in particular ‘economic conditions’ showed a marked improvement,” Evans said.

“It is also interesting to note that overall awareness of ‘budget and taxation’ news is down significantly from a year ago when 37.1% of respondents recalled news on this topic. That difference can be largely attributed to a fall from 17.6% to 3.7% in those respondents recalling news on taxation.”

Other well-recalled news items covered were: employment (15.7%, up from 11.1% in December); interest rates (15.6%); and international conditions (12.0%). Despite no move by the Reserve Bank over the intervening period news on interest rates was much more positively received while the pessimism around international conditions eased, he said.

“Respondents, who regularly assess the news on employment as unfavourable, were somewhat more concerned in this survey.”

There was one significant movement within the components of the index: ‘the family finances index compared to a year ago’ fell 5.3%. This component is now at its lowest level since June 2014 when respondents were shaken by the May Budget. Housing sentiment lifted in March with the ‘time to buy a dwelling’ index rising 7.0%. However, that increase only recovered the 7.8% fall in February. The recovery was mainly attributed to a sharp turnaround in Victoria where the state government recently announced a range of new measures including abolishing stamp duty for first home buyers. Despite this, the national index is still drifting lower, falling 4.9% over the last year, compared to a 13% fall over the previous year.

“Markets accept the view that rates will remain on hold in 2017 but are pricing in at least two hikes from the Reserve Bank next year. We expect that growth in the economy will slow in 2018 as the residential construction boom unwinds,” Evans said.

“As we saw in today’s report, households are concerned about their finances, largely because of weak income growth. This concern is unlikely to fade in 2018 appropriately constraining household spending and discouraging investment. That is no environment for higher rates. Accordingly, we expect rates will remain on hold throughout 2018 as well.”