By Kymberly Martin

With more inclined to making major purchases

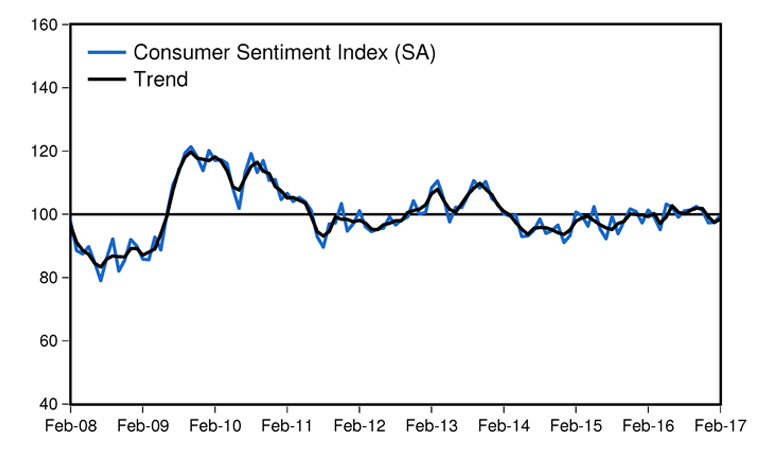

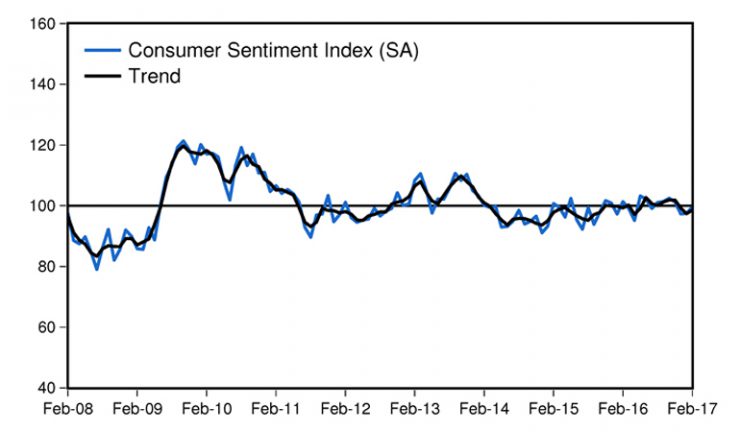

The Westpac Melbourne Institute Index of Consumer Sentiment rose 2.3% to 99.6 in February, from 97.4 in January, but consumer sentiment still remains below its October-November levels.

“At just below 100 the Index is in slightly pessimistic territory with consumers reporting family finances under pressure and a mixed outlook for the economy,” Westpac senior economist Matthew Hassan said. “The sub-index tracking views on ‘family finances versus a year ago’ posted the biggest gain, up 4% but coming from a weak starting point after a 10.6% slide over the previous three months. The sub-index tracking expectations for ‘finances over the next 12 months’ has been steadier, posting a small 1.1% gain in February. On a combined basis, consumer views on family finances are still down 6.5% on a year ago and are 5.4% below their long run average,” he said.

However, consumers are more positive on the economy. Near term expectations posted a solid gain, the ‘economic conditions, next 12 months’ sub-index up 2.8%, recovering all of the ground lost following the surprisingly weak September quarter national accounts.

Consumers are also little more inclined towards making major purchases. The ‘time to buy major household item’ sub-index rose 2.2%, building on a 4.9% bounce in January to be back near November levels. The rebound is a hopeful sign that the soft patch in retail sales late last year has not extended into 2017.

Concerns too about potential interest rate increases may have impacted sentiment towards housing. “The ‘time to buy a dwelling’ index fell sharply, declining 7.8%. The index is now at its lowest level since May 2010 when the Reserve Bank was near the end of its last tightening cycle. Victoria, Queensland and WA all recorded 10% plus declines in the month although the NSW Index remains the weakest across the states. The fall points to a shaky start to the new year for housing markets,” Hassan said.