By Kymberly Martin

Better outlook for 2017 first-half.

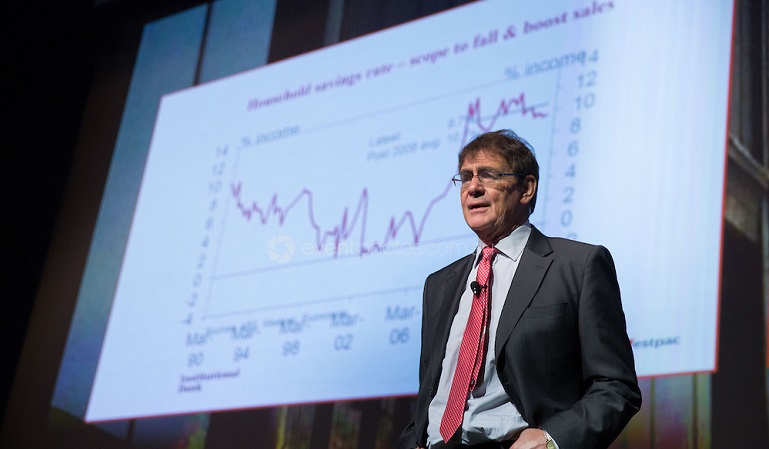

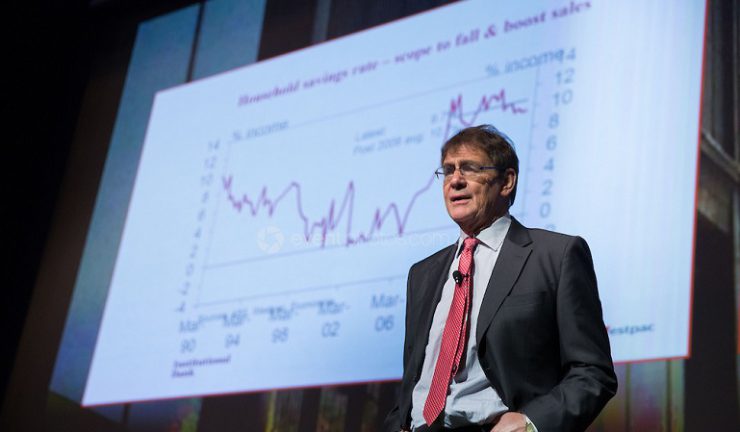

There was a strong rebound in annualised growth rate for December/January, in the latest report from the Westpac-Melbourne Institute Leading Index – the sixth consecutive month where the growth rate in the Index is at or above trend. “This followed a period of 15 consecutive months where the growth rate has been below trend,” Westpac chief economist, Bill Evans (pictured) said. While Westpac concurs with Reserve Bank forecasts of 3% growth through 2017, he said potential complications lie with the Australian dollar.

“Although the recent strength in the Australian dollar is entirely understandable given the surge in commodity prices, the intensity and timing of any boost to spending from the rising terms of trade is always uncertain. On the other hand a higher Australian dollar can be expected to challenge services and manufacturing export growth. For now our forecasts for commodity prices and the Australian dollar envisage that we are near the peaks although we do not expect much correction to commodity prices or the Australian dollar through the remainder of 2017,” Evans said.

There were concerns for growth beyond 2017, however, with prospects for 2018 looking discouraging. “Housing construction is likely to be contracting through 2018 while export growth will slow and the terms of trade are likely to be falling, slowing nominal income growth.”

Prospects for an offsetting boost from household spending and business investment were not encouraging either, however a substantial correction to the Australian dollar should provide considerable relief for growth prospects in 2019, he said.

“Reserve Bank board minutes for the February meeting confirmed the board’s view that the economy is likely to grow by around 3% in 2017 and 2018. The assessment around the outlook for consumption growth was a little more subdued, but buoyant housing markets in both Sydney and Melbourne are continuing to weigh on their considerations,” Evans said.