The collapse that affected 300 stores and almost 3,000 staff.

January 4: Trading halt as Dick Smith enters administration

Dick Smith’s public crisis came to an abrupt end when the company’s lead bankers, NAB and HSBC appointed James Stewart from Ferrier Hodgson as receiver. The company, overwhelmed by debt and unable to pay suppliers to secure stock, then called in McGrathNicol to act as its voluntary administrator.

Dick Smith Holdings chairman Rob Murray: “It is with considerable regret that the board has placed the company into voluntary administration. Sales and cash generation were below management expectations, continuing a trend experienced during 2Q2016. The company explored alternate funding, however the directors formed the view that any success in obtaining alternate funding would not have been sufficiently timely to support short-term funding requirements and allow the company to order required inventory during the next four to six weeks.”

January 11: CEO Nick Abboud resigns

Dick Smith CEO, Nick Abboud tendered his resignation, effective immediately, according to a company statement from Ferrier Hodgson. Don Grover will take the reins as interim CEO and will assist the receivers and managers, James Stewart, Jim Sarantinos and Ryan Eagle, with the operations of the business as they work through the realisation and restructuring opportunities for the retailer.

January 13: Dick Smith to host creditors

Ferrier Hodgson placed advertisements online and in national and international newspapers to invite expressions of interest for the Dick Smith and Move businesses in Australia and New Zealand, to be submitted on or by 27 January 2016.

Simultaneously, Dick Smith has scheduled the first creditors meeting in the Sydney CBD. The meeting will determine whether or not to appoint a committee of creditors, and if so, who the committee members will be.

January 15: First creditors meeting answers questions

McGrathNicol administrator Joe Hayes (pictured below) answered questions relating to the following:

Gift cards

“The customer creditors are unsecured creditors – that’s the appropriate legal position under the Corporations Act. I understand that customer creditors have a number of other means by which they can be compensated, such as credit card recharges and the like so we are conscious of the issue.”

Extension between creditors meetings

“We will seek an extension for the convening period [for the next creditors meeting from 28 days] by up to six months following a request from the receivers.”

Staff

“It is business as usual. The receivers are responsible for instructing the staff and all staff are being paid and employed by the receivers.”

Expressions of interest

“Far too early to comment on the 45 offers that have been received. It is encouraging that there are so many offers.”

Possible causes of collapse

“It’s too early to focus on anything specific, I think. The company grew and in order to grow they acquired debt. One of our roles will be to assess all of the activities of the company and how were incurred and generated and what decisions were made by different groups of people at different times.”

Departure of Nick Abboud

“It is not uncommon in these types of situations under a new authority structure for there to be a different type of leadership.”

January 18: 12 head office staff made redundant

Ferrier Hodgson has laid off 12 Dick Smith staff in the group’s support office, across a variety of departments.

The statement read, “As part of ongoing preparations for a potential sale of the business, staff were informed on Thursday 14 January 2016 that 12 positions from head office will be made redundant. This decision was based on the predicted ongoing needs of the Dick Smith Group and designed to assist in ensuring its commercial viability. It is not in any way a reflection of the employees’ performance or work ethic.”

January 22: DJ concession stores close, second creditors meeting delayed

Not only is it likely creditors will have to wait a bit longer as find out the company’s future but it will also close its national network of outlets located in 27 David Jones department stores.

McGrathNicol indicated that it might have to defer a second creditors meeting scheduled for February until August 2. It is understood that the delay would give the administrators more time to investigate creditors’ claims and a similar application will be made for the New Zealand operations.

In a statement from receivers Ferrier Hodgson the ‘Powered by Dick Smith’ concession stores will close with the loss of 181 jobs on January 27, 2016. Interestingly, the receivers said Dick Smith was trying to “identify opportunities for future employment for as many of the affected staff as possible, mostly part-time and casual, through the Dick Smith network.”

January 27: Harvey gives helping hand to DSE shoppers

A number of Dick Smith customers left without Fitbits after ordering and paying for them, prior to January 4, will now be able to get them from Harvey Norman, according to NZ media reports.

Shoppers will have to produce their original Dick Smith purchase order that shows a deposit of full payment for the product before February 29. Fitbit and Harvey Norman have said if the customer paid a deposit they will be able to pay the balance to Harvey Norman before receiving the product, and if paid in full, there are no extra costs.

Harvey Norman will not refund any Dick Smith purchases but will replace faulty goods. Any warranty claims can be made through the Fitbit website or via Harvey Norman.

January 29: DSE receives 50 EOIs

Around 50 expressions of interest have been received for the Dick Smith business. The anticipated timetable was for final offers by the end of the month and payment taking about 90 days, putting it at the end of May.

Administrators McGrathNicol represented by barrister Jack Hynes successfully asked the Federal Court yesterday for an extension of time to report to the company’s creditors so the business can be sold instead of placed into administration.

February 5: Investigation into underpayment to employees

The Fair Work Ombudsman launched an investigation after evidence emerged that failed electronics chain Dick Smith might have underpaid its employees. It follows a statement by Australian Securities and Investments Commission (ASIC) that it has commenced inquiries into whether its prospectus adequately disclosed its true state of affairs ahead of its $520 million initial public offering in December 2013.

February 25: All Dick Smith and Move stores to close

The 301 remaining Dick Smith and Move stores across Australia and New Zealand, excluding airport locations, will be closed. The closure process is expected to take approximately eight weeks, will impact 2,460 staff in Australia and 430 staff in New Zealand.

March 2: Intellectual property up for sale

Following the news of the Dick Smith store closures, receivers, Ferrier Hodgson are inviting expressions of interest (EOI) for the intellectual property of Dick Smith. Expressions are sought for the following Australian and New Zealand assets: Dick Smith and Move online businesses, brands and trademarks, customer databases, websites and domain news.

March 4: Employees offered new start

Flight Centre has received a very strong response from affected Dick Smith employees for job openings around the country with the travel consultancy chain. Within a matter of hours, Flight Centre received hundreds of email responses, acting public relations manager, Laura Carlin, told Appliance Retailer.

Best & Less, now run by former Dick Smith executive, Rodney Orrock, is also calling out to Dick Smith employees to help them find another role and are asked to message the retail chain. New Horizons Learning Centre has also addressed Dick Smith employees a statement on LinkedIn from CEO, Rahul Kumar. Payam Data Recovery also sought two experienced people to join its Sydney team with first preference being given to ex-Dick Smith employees.

March 15: Kogan acquires Dick Smith IP

Ruslan Kogan invested an undisclosed amount to buy the Dick Smith Intellectual Property; however, the fallout from that chain’s demise is still dominating the media. Kogan swallowed the Dick Smith brand names, along with all trademarks and online operations and the names and address of over a million Dick Smith customers after a highly contested two-month auction.

March 23: ASIC searches for answers

The Australian Securities and Investments Commission (ASIC) will investigate the failure of Dick Smith and identify what went wrong. The revelation was made during the ASIC Annual Forum, when questions were put to ASIC chairman Greg Medcraft, and commissioners Peter Kell, Cathie Armour, John Price and Greg Tanzer.

April 13: Hope for Dick Smith gift card holders?

Australia’s largest investment bank, Macquarie Group, has backed a proposal to secure funds from the sale of gift cards in a trust to ensure customers are not left empty-handed. The suggestion was made after customers were left with thousands of dollars worth of unredeemable Dick Smith gift cards.

Macquarie Group has said that establishing separate trusts for funds from gift cards may be a way to protect their holders in the event of a collapse. “If the trust was properly established and administered, the cardholder may have a much higher likelihood of being repaid in the event of insolvency,” global head of corporate communications and investor relations, Kristine Neill, wrote in a submission to a Senate inquiry.

April 22: Shareholders want class action

An investigation is underway by law firm, Bannister Law, into a possible consumer and shareholder class action against private equity firm, Anchorage Capital Holdings, and the directors, officers and auditors of Dick Smith.

Bannister Law is scrutinising the disclosure and financial information that was provided to investors of the DSH prospectus dated November 2013. The firm is also assessing whether sufficient and reliable information was provided to potential stakeholders to allow them to make an informed investment decision and whether there were any breaches of the Corporations Law and ASX Listing Rules.

May 4: Online business goes live under Kogan ownership

The new Dicksmith.com.au and Dicksmith.co.nz websites that were scheduled to relaunch on June 1 2016, have gone live today with a ‘Relaunch Sale’ to celebrate.

The store, which leverages the same existing back-end logistics and supplier arrangements as Kogan.com, will stock more than 5,500 products including smartphones, cameras and appliances, with more than 1,800 products available for fast dispatch or next day delivery.

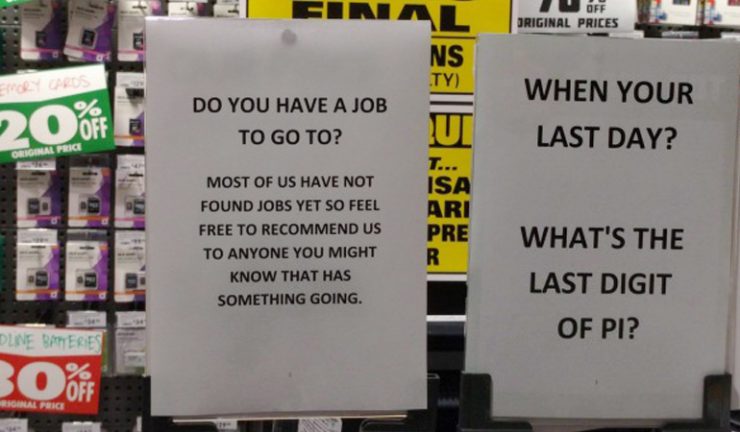

May 27: Help for Dick Smith employees

Former Dick Smith employee of 18 years, Graham McFarland launched a Facebook page, which has 965 active members, to help workers find employment. McFarland told Appliance Retailer that after the final announcement that Dick Smith stores were to be closed, some of his colleagues started a Facebook page that now holds over 5,000 members, including current and past employees.

June 15: Receivers to question DSE directors

Dick Smith receiver Ferrier Hodgson will question former directors of the electronics retailer after uncovering concerns during its investigation ahead of its collapse in January. The Australian Securities and Investments Commission has already granted permission for Ferrier Hodgson to examine Dick Smith’s former board and find out why the business failed.

Ferrier Hodgson will report back to ASIC on the examinations and the corporate watchdog is likely to take action based on the result of these interrogations, which are conducted in public and the subjects answer questions under oath.

July 11: Receivers set court date

Ferrier Hodgson partner James Stewart has notified Dick Smith’s creditors that 10 former directors and managers will be examined in the NSW Supreme Court from September 5 2016.

These include former CEO Nick Abboud, former chairman Rob Murray, company secretary David Cooke, director of commercial property, procurement and supply chain, John Skellern, non-executive directors Lorna Raine, Michael Potts, Robert Ishak and Jamie Tomlinson, and Phil Cave and Bill Wavish, of Dick Smith’s former private equity owner, Anchorage Capital Partners.

July 15: McGrath Nicol releases report

Inventory continued to grow, new stores were being opened, despite same store sales experiencing a decline year-on-year, and purchasing decisions were based on rebates instead of customer demand. McGrathNicol has attributed the above action to the demise of Dick Smith. The administrators provided an in-depth report to creditors and Appliance Retailer identified the report’s key points.

July 25: Liquidator appointed

The second Dick Smith creditors’ meeting was held at the Wesley Conference Centre in Sydney, where creditors voted to liquidate the company and appoint McGrathNicol as the liquidator. The key findings from the McGrathNicol report released on 13 July 2016 were presented at the meeting, where creditors also agreed to form a committee of inspection to consult with the liquidators.

September 26: Dick Smith chairman faces court

Dick Smith chairman Robert Murray faced the NSW Supreme Court for examination. He reportedly maintained that he was unaware of the factors that led to the retailer’s demise until it was too late, and defended the company’s strategy of rolling out new stores and taking on more debt.

He said he relied upon the sales forecasts provided by Dick Smith’s chief financial officer Michael Potts and chief executive Nick Abboud. He later learned that what he had thought were brick-and-mortar sales figures, included click-and-collect purchases.

October 4: Anchorage MD faces court

Anchorage Capital Partners managing director, Philip Cave gave evidence before the NSW Supreme Court, defending the policy of maximising rebates that was reportedly initiated under an internal scheme, Project Enabler.

In 2013, Dick Smith ramped up its reliance on controversial supplier rebates under the project outlined in an external review of the company’s supply chain, after it was purchased by Anchorage.

He said when Anchorage purchased the business, there was concern that “rebates were under pressure and we wouldn’t be able to obtain the same level of rebates independently” due to the buying scale of Woolworths, Big W and Dick Smith, according to media reports.

October 6: Dick Smith CEO faces court

Former Dick Smith CEO, Nick Abboud faced the NSW Supreme Court, admitting that rebates was a key focus for the retailer.

When asked if vendor rebates influenced the decisions made by the company’s buyers: “The buyers focus on getting sales and profits, and there interest is buying the right stock. That’s the priority of the buyer. The outcome of doing that, the strategy of the company is, yes do that, but to sell out the product, you need the supplier’s help to market it,” he explained.

October 6: Dick Smith CFO faces court

Former Dick Smith CFO, Michael Potts told the NSW Supreme Court that he was not concerned that over-and-above (O&A) rebates were distorting buying decisions, until the accounting treatment of rebates was discussed with the company board in late 2015.

Furthermore, when questioned by Ferrier Hodgson if he was concerned about over-and-above (O&A) rebates being a key focus for the company, he responded “No.”